Dear PGM Blog reader,

In this weekend blog article, we want to take the opportunity to discuss with you, why Investing in iQiyi, can be lucrative for growth investors.

INTRODUCTION:

Qiyi was founded on April 22, 2010 by Baidu, which is China’s largest online search engine, and Providence Equity Partners, and changed its name to iQiyi in November 2011.

iQiyi, is an online video platform based in Beijing, and is currently one of the largest online video sites in the world, with nearly 6 billion hours spent on its service each month, and over 500 million monthly active users.

Yu Gong, Founder and CEO of iQiyi Inc., and Robin Li, CEO of Baidu, ring the opening bell at the Nasdaq Market Site to celebrate iQiyi Inc.’s initial public offering on March 29, 2018.

On March 29, 2018, the company issued its IPO (initial public offering) in the U.S.A. and is trading under the symbol IQ on the NASDAQ exchange.

IQIYI VERSUS NETFLIX:

iQIYI is involved in the provision of online entertainment services in China, for which the company follows a business model quite similar to that of Netflix (NASDAQ:NFLX).

However, unlike Netflix, the China-based streaming service also allows its users to upload content to the platform. Furthermore Netflix is subscriber based whereas iQIYI has both subscription and ad revenue, for which iQIYI ad revenue was equal to its subscription revenue last quarter.

Back in 2015, iQIYI had 11 million subscriber, at the end of 2016, it had 30 Million subscribers and in February of 2018 it reached 60 million (about half of Netflix).

As can be seen in below table, in FY-2017, iQIYI posted sales growth of 55% versus a sales growth of 32% by Netflix in the same period. Based on this and the population of China’s we can conclude that iQIYI is still in an early phase of its growth compared to Netflix.

|

Netflix |

iQIYI |

|

| Subscribers |

119 million |

60 million |

| Sales in 2017 |

US$ 11.7 billion |

US$ 2.7 billion |

| Sales Growth in 2017 |

32% |

55% |

| Market Cap |

US$ 156 billion |

US$ 23.7 billion |

As we can be seen from above table, Netflix has a market cap is about 6.6x larger than the one of iQIYI but only has 2x the subscribers.

Netflix has a huge subscriber premium compared to iQIYI for which iQIYI subscriber price is about ¼ of the one of Netflix.

Netflix has a stretched valuation with a price/sales ratio of 12.3 ratio, while iQIYI has a (much better) price/sales ratio of 8.23.

Below chart shows the performance of the shares of iQIYI (blue chart) versus the one of Netflix (red chart) YTD.

PGM CAPITAL ANALYSIS & COMMENTS:

iQiyi has caught the attention of investors, being dubbed the Netflix of China after being spun off from Baidu.

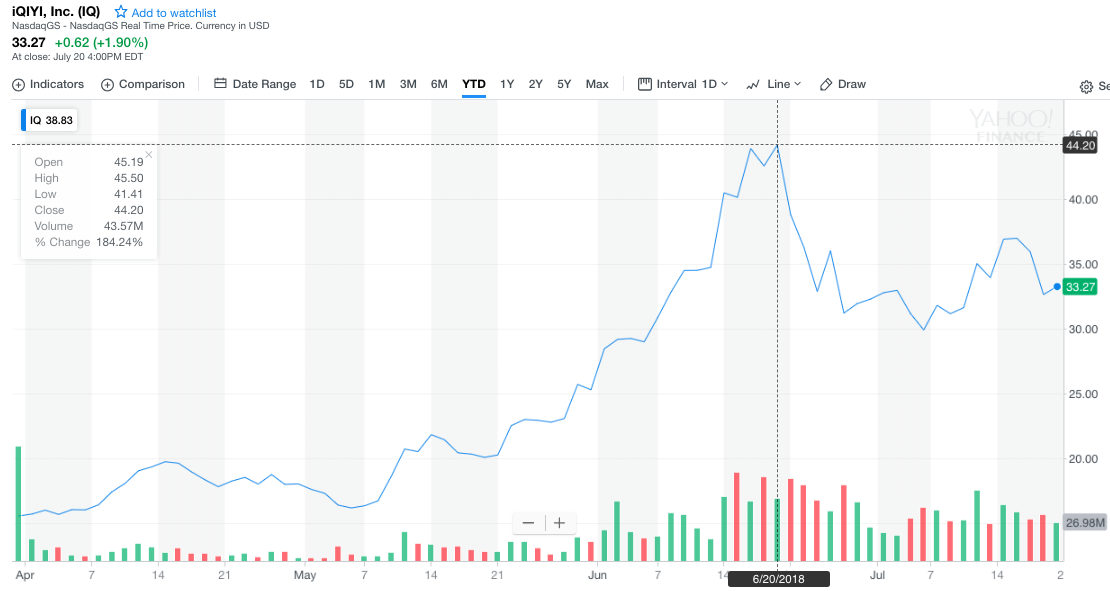

As can be seen from below chart, shares of the company took off after its Q1-2018 earnings report, and reached US$ 44.20 a share on June 20.

The stock price of the company has fallen to approx. US$ 30.00 a share – a 30% pullback from its value of June 20, 2018 – on fears about the U.S. government’s tariffs on Chinese goods and a crack-down on Chinese investment in U.S. technology.

If we combine the projected strong growth of the online video sector in China with iQIYI’s existing leading position, it’s easy to see its potential as a multibagger and a growth stock for a portfolio.

Comparing iQIYI’s with its main competitors on the mainland, both Chinese Internet behemoths Tencent and Alibaba are very rich valued, with price/sales ratio of approx. 13 for both companies, this compared with a price/sales ratio for iQIYI of approx. 8.23.

As the Chinese market is maturing, investors will eventually treat iQIYI the same way they are already treating Tencent, Baidu and Alibaba.

Based on the above we have initiated our coverage of the shares of iQIYI, with a STRONG BUY rating.

If you think you have it in you to be able to buy iQIYI and chill over the next three to five years, we believe you have found yourself your next multibagger.

Disclosure:

We are long iQIYI, Baidu, Tencent and Alibaba, but don’t own shares of Netflix.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind that; share prices don’t move in a straight line, that Past Performance Is Not Indicative Of Future Results and that technology stocks and stocks of emerging markets, experience a higher volatility than the ones of develop market big-caps.

Yours sincerely,

Eric Panneflek