Dear PGM CAPITAL Blog readers, today, July 15th 2011, BHP Billiton Ltd, world biggest and most diversified mining corporation [ASX: BHP, NYSE: BHP, LSE: BLT, JSE: BIL] and Petrohawk Energy Corporation (“Petrohawk”) [NYSE: HK] announced they have entered into a definitive agreement for BHP Billiton to acquire Petrohawk for US$38.75 per share by means of an all-cash tender offer for all of the issued and outstanding shares of Petrohawk, representing a total equity value of approximately US$12.1 billion and a total enterprise value of approximately US$15.1 billion.

The acquisition will give BHP assets covering about one million acres (400,000 hectares) in Texas and Louisiana, with an estimated 2011 production of about 950 million cubic feet (26.9 million cubic meters) equivalent per day, or 158,000 barrels of oil equivalent each day.

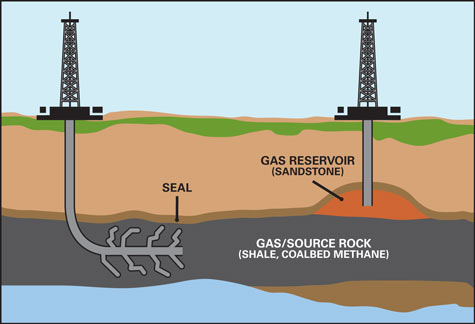

The deal comes just months after BHP bought a $4.75 billion stake in a shale gas field in Arkansas, which marked the first move by the company into the rapidly growing U.S. shale gas business.

When 5 billion new Capitalist are emerging for physiological needs to safety needs in accordance with Maslow’s Hierarchy of needs, this cannot happen without a dramatic increase in their demand for all basic materials, including food. In our opinion BHP Billiton Ltd, as world biggest and most diversified mining corporation have the potential to profit most from this development.

Based on the above we have a STRONG BUY rating on the company’s stock.

Disclosure:

We own BHP Billiton shares in our personal portfolio since November 2008.

Before following any investing advice, always take your investment horizon and risk tolerance into consideration and keep in mind that the price of Commodities as well as the stocks of their producers can be very volatile and that sharp corrections might happen in the short term.

Yours sincerely

Eric Panneflek

Chairman