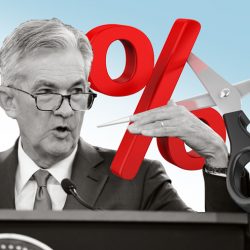

Are You Prepared for the Era of Near Zero and Negative Interest rates?

Dear PGM Capital Blog reader, In this weekend’s blog article, we want to discuss the consequences of the current trend of near zero to negative interest rates in the developed economies. THE FED CUT INTEREST RATES FOR THE THIRD TIME IN 2019 On Wednesday, October 30, the USA Central Bank, “The FED” for the third time[…]