Dear PGM Capital Blog readers,

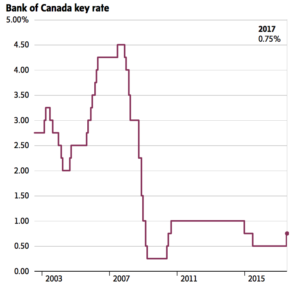

On Wednesday, July 12, the Bank of Canada (BOC) announced it’s raising the benchmark lending rate from 0.5 percent to 0.75 percent, which is Its first rate hike in nearly seven years as can be seen from below chart.

The central bank raised its overnight lending rate by a quarter-percentage-point Wednesday, to 0.75 percent from 0.5 percent, citing “bolstered” confidence that the Canadian economy has emerged from years of sputtering growth.

Ultra-low interest rates of the past seven years, have encouraged Canadians to load up on mortgage debt in recent years, driving up home prices and home construction.

Why did the BOC raised its Key Rates:

The Bank of Canada is worried about inflation making a comeback in the economy, and hiking interest rates is a proven tool for fighting inflation, which eats away at people’s savings and reduces their spending power.

The commercial banks in Canada, will pass on the higher interest rate to borrowers. Canadian with a variable-rate mortgage or a home equity line of credit (HELOC), meaning a loan against the value of your home, their interest costs will rise as soon as their lender raises their rates. As a consequence of this they will be paying more in interest costs and less towards the principal.

Canadians who have a fixed-rate mortgage, their interest rate won’t rise until it’s time to renew. At renewal, they may find the mortgage rates offered to them are higher than last time around, and they will be facing larger monthly payments.

PGM CAPITAL COMMENTS & ANALYSIS:

On Wednesday July 12, Canada became the first Group of Seven countries to join the U.S. in raising interest rates, potentially fueling speculation the world’s central bankers are heading into a tightening cycle.

As can be seen from below chart, the Bank of Canada’s burgeoning optimism sent the Canadian dollar shooting up more than a full cent to nearly 79 US-Dollars cents on Wednesday, as investors brace for further rate hikes in the months ahead.

As a consequence of this, the Canadian Dollar closed the trading week on Friday, July 14 at a 1-year high of 79.11 USD cents, against the US-Dollar, as can be seen from below chart.

By raising their key rates, the Canadian Central Bank has acknowledge that inflation is rising in the country and most probably in the world.

Based on the fact that basic commodities and precious metals are the hedge against inflation, commodities based currencies like the; Norwegian Crone, Swedish Crone and Australian Dollar also jumped to a YTD-High, against the US-Dollar, as can be seen from below charts.

On the other hand the USD-INDEX closed the week at its lowest point YTD as can be seen from below chart.

Rising inflation and subsequently rising interest rates, will have also a positive effect on Gold, Silver and other precious metals but on the other hand will destroy savings, bonds and pensions.

Rising interest rates will raise borrowing costs for individuals, companies and governments.

With the world up to its eye-balls in debt, rising interest rates might lead to massive defaults, which at the end might trigger a big recession or even depression, which might let the one of 2007-2009 look like picnic.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind that the market can remain longer irrational, than you can remain solvent and that commodity prices as well as the securities of their producers, can be very volatile and that sharp corrections might happen in the short term.

Yours sincerely,

Eric Panneflek