Dear PGM Capital, blog readers,

In this weekend blog edition, we want to discuss some of the most important events that happened in the global capital markets, the world economy and the world of money in the week of April 10, 2017:

- USA President Trump Said ” The US-Dollar is getting Too Strong”.

- Gold at 5-Month High.

TRUMP “THE US-DOLLAR IS GETTING TOO STRONG”:

On Wednesday, April 12, in the interview with the Wall Street Journal, USA President, Mr Donald Trump said:

“I think our dollar is getting too strong, and partially that’s my fault because people have confidence in me. But that’s hurting — that will hurt ultimately.”

He also said:

“It’s very, very hard to compete when you have a strong dollar and other countries are devaluing their currency.”

Mr Trump added that he had changed his mind on China’s management of the renminbi, despite saying just weeks ago that Beijing was the “grand champion” of currency manipulation. He also threatened throughout his campaign to officially label China a manipulator on day one of his presidency.

GOLD AT 5-MONTH HIGH:

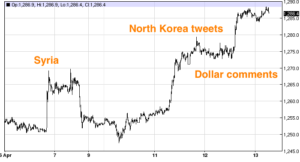

As can be seen from below chart, everything USA President Mr. Donald Trump has done over the past week has been positive for gold.

The Syrian airbase strike, increasing tensions with North Korea, and his comments on the U.S. dollar have all caused gold prices to swell nearly 3% in the week of April 10, 2017.

Other safe-haven assets like Silver and other precious metals benefited from Trump’s statements, with spot gold, to close the short trading week on Thursday April 13, at US$1,283.70 an ounce, as can be seen from below chart.

PGM CAPITAL COMMENTS & ANALYSIS:

Trump and the Strong US-Dollar:

On Friday, April 14, in a highly anticipated report, the U.S.A. President Donald Trump’s administration declined to name any major trading partner as a currency manipulator, backing away from a key Trump campaign promise to slap such a label on China.

The semi-annual U.S. Treasury currency report did, however, keep China on a currency “monitoring list” despite a lower global current account surplus, citing China’s unusually large, bilateral trade surplus with the United States.

The U.S. dollar is already in troubled waters amid increasing distrust in the government and the Fed’s monetary policies. But add to this increasing trade disputes with foreign nations, and the result is toxic for the greenback.

Trump’s continued support for a weaker U.S. dollar is an abrupt turnaround from a 20-year policy of the U.S. government publicly favoring a strong currency.

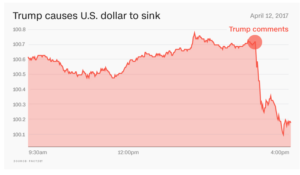

As can be seen from below chart, immediately following the release of Trump’s dollar comment on Wednesday, April 12, the U.S. Dollar Index dropped 0.7%.

Some economists have warned that Trump’s stance, which he established during last year’s presidential election could spark a currency war.

A currency war works like a price war. It’s the repeated competitive cutting of prices below competitors’. In a currency war, central banks repeatedly devalue their currencies to undercut each other.

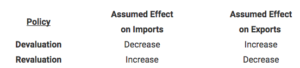

For a country, devaluing its currency increases the purchasing power of foreign buyers, meaning increased exports. The catch is devaluation also increases the cost of imports.

And it’s vice-versa for revaluing a currency. Increasing the value of a currency will decrease the purchasing power of foreign buyers, meaning lower exports. But it will also decrease the cost of imports.

Below table shows the assumed effect of devaluation and revaluation monetary policies.

All this works well and good, with a balance. But when one or more countries find themselves in desperate need of fixing their trade deficit, this tinkering can lead to an all-out currency war.

Gold at 5-Month High:

On Friday April 14, Gold hovered near the 5-month high hit in the previous session and was set for its biggest weekly percentage rise since June as a weaker dollar and geopolitical worries over the Middle East and North Korea stoked safe-haven demand.

Bullion prices hit their highest since early November at US$1,288.64 an ounce the session before.

As can be seen from below chart, the metal was on track for its biggest weekly gain since early June, up about 2.6 percent this week.

Gold, often seen as an alternative investment during times of political and financial uncertainty, benefited from the risk-averse sentiment in the market.

Despite being officially decoupled for over 45 years now, the price of gold still trades inversely to the U.S. dollar for the most part. Instability in the dollar will serve as a complimentary catalyst to geopolitical breakdowns that will continue to drive gold prices higher and the broader equity markets lower.

Despite recent upward movement, we believe that gold is still a buy.

Among other precious metals, spot silver was up 0.1 percent at US$18.52 an ounce, after touching a five-month high of US$18.599 in the previous session. Platinum was up 0.2 percent at $$971.15 and palladium was up 0.1 percent at US$795.08.

Last but not least, before following any investing advice, always take your investment horizon and risk tolerance into consideration and keep in mind that, the market can stay longer irrational, than you can remain solvent and that commodity prices as well as the securities of their producers, can be very volatile and that sharp corrections might happen in the short term.