Dear PGM Capital blog readers,

In this weekend blog edition, we want to discuss some of the most important events that happened in the global capital markets, the world economy and the world of money, in the week of July 24, 2017:

- Royal Dutch Shell reported blockbuster Q2-2017 earning on July 27, 2017.

- Crude Oil Bounced back.

- Amazon.com Q2-2017 earnings missed by a mile.

ROYAL DUTCH SHELL REPORTED BLOCKBUSTER Q2-2017 EARNINGS:

Royal Dutch Shell (RDSA.AS) world’s second biggest fully integrated-, and Europe’s largest Oil Company, on Thursday, July 27, 2017, reported its Q2-2017 financial results, for which the reported profits were three times larger than at this time last year.

Please watch below video for a highlight of the Q2-2017 financial results of the company:

Q2-2017, Dividend:

On Thursday, July 27, he Board of Royal Dutch Shell plc declared an interim dividend in respect of the second quarter of 2017 of US$0.47 per A ordinary share (“A Share”) and B ordinary share (“B Share”).

- Ex-dividend date RDS A and RDS B ADSs, August 9, 2017

- Ex-dividend date RDS A and RDS B shares, August 10, 2017

- Record date, August 11, 2017

- Payment date, September 18, 2017

The company provides shareholders with a choice to receive dividends in cash or in shares via the Dividend Reinvestment Program (DRIP).

OIL PRICES BOUNCED BACK IN THE WEEK OF JULY 24, 2017

The OPEC produces meeting earlier in the week of July 24 kick-started the rally after one of its two members excluded from an extended output cuts deal were brought into the fold.

Nigeria promised to limit its daily production to 1.8 million barrels per day, although that’s above the country’s current level of 1.6 million barrels, it removes any risk Nigeria will ramp up output enough to offset cuts elsewhere.

Saudi Arabia also pledged some short-term additional support by saying it will limit its own exports to 6.6 million barrels per day next month, which would be around a million barrels per day less than the same month last year.

Based on the above, the price of West Texas Intermediate Crude, went from US$ 45.84 a barrel on Monday July 24 to close on Friday July 28 at US$ 49.81 a barrel, a rise of approx. 8.7 percent in one week as can be seen from below chart.

AMAZON.COM EARNIGS BIG MIS:

On Thursday July 27, after the closing bell, Amazon.com (NASDAQ: AMZN) delivered a disappointing second quarter report as follows:

- Per-share profits of only 40 cents, though, weren’t even close to the consensus estimate of US$1.42 a share, and down 77 percent from the bottom line produced a year earlier.

As can be seen from below chart, the company’s share declined approx. 7 percent, from its peak of Thursday, July 27 of approx. US$ 1083.20 a share, to close on Friday, July 28 at US$ 1,018.75, as can be seen from below chart.

PGM CAPITAL COMMENTS & ANALYSIS:

Royal Dutch Shell:

Royal Dutch Shell financial results of Q2-2017, make the fundamentals for the company even better. Based on the company’s Price-to-Book of near one (1), a forward Price-to-Earning of around twelve (12) a strong balance sheet for which the shares of the company have a dividend yield of approx. 6.8 percent, we upgrade the shares of the company to a STRONG BUY, and place a price target of Euro 28.00 on the shares of the company.

Crude Oil Prices bounced back:

On Tuesday, July 25, oil prices, enjoyed their biggest one-day rally for this year so far and have continued to rise during the week.

The funny thing about this is, that shares of most Oil- & Oil Services companies didn’t rise last week in line with the increase of the Oil prices, which make them super attractive if oil prices remain at this level.

Based on this we have raised our rating for the Oil Services Company, specially the beaten down drillers, to a BUY.

Amazon.com earnings slump:

Most Amazon.com investors would ask themselves, what in the heck happened that could drag the company’s earnings so far away from expectations in Q2-2017?

Are Costs the Company’s problem?

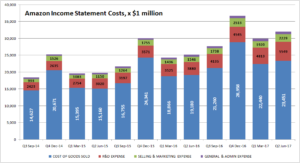

Below image shows a visualization of Amazon’s costs, in which we can clearly see that the company’s costs are growing faster than its revenue.

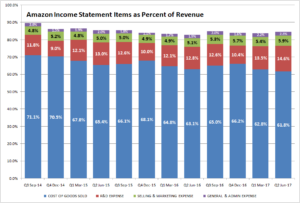

The picture looks even more ugly, when we take a look how each of the company’s expenses relates to its revenue.

As can be seen from below chart, Amazon’s operating expenses have been inching higher since the third quarter of last year. Specifically, Q3-2016 total operating costs including the cost of goods sold were 82.8% of revenue, and last quarter, they increased to 84.6% of revenue.

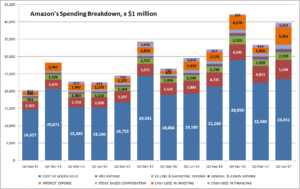

Though cashflow used for investing activities is almost always negative, last quarter’s US$5.05 billion spend on investing – mostly capital expenditures – tops off a long string of rising costs.

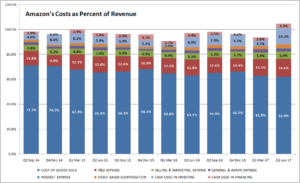

Below chart shows a breakdown the company’s expenses that don’t appear on their income statement.

When we examine below chart which gives a breakdown of all the aforementioned expenses as a percentage total revenue, we’ll see that these exceeded 100% in Q2-2-2017, which is the root cause of the Q2-2017 negative free cash flow.

After reading the above, the bottom line is simple, with a Price-to-Earning of 190, a Price-to-Book of 22 and NO DIVIDEND payment, we can definitely conclude that the shares of Amazon.com are a HUGE BUBBLE, based on this we, as a contrarian, maintain our SELL rating on the shares of the company.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind that the market can remain irrational longer, than you can stay solvent.

Yours sincerely,

Eric Panneflek