Dear PGM Capital blog readers,

On Friday February 2, all three major U.S. stock indexes tumbled with the Dow seeing its worst percentage drop since June 2016 as climbing bond yields prompted a selloff in equities.

- The Dow Jones Industrial Average fell 665.75 points, or 2.54 percent, to 25,520.96 points as can be seen from below chart.

- The S&P 500 lost 59.98 points, or 2.13 percent, to 2,762 points.

- The Nasdaq Composite dropped 144.92 points, or 1.96 percent, to 7,240.95 points.

INTRODUCTION:

Solid jobs data, showing the strongest annual wage growth since 2009 rattled investors who fear accelerating inflation will usher in more interest rate hikes than expected this year, sent bond bulls scurrying and rattled equity investors who haven’t seen a week this bad in two years.

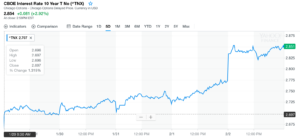

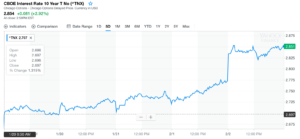

The tandem selling accelerated after Dallas FED President Robert Kaplan suggested officials may need to hike more than three times this year to cool the advance. Based on this comment, the 10-year Treasury yield popped above 2.85 per cent for the first time since January 2014 as can be seen from below chart.

The rapid rise in the 10-year note – the world benchmark for corporate lending – sent shock waves through a market grown accustomed to low inflation and a steady tick higher in stocks.

Below 5-day chart of the 10-year note, shows the spike of the 10-year note in the week of January 29 – February 2, 2018.

CURRENCIES:

CURRENCIES:

The U.S. dollar strengthened against its major rivals on the back of the December jobs report on Friday, and gained 0.54 percent, – to close the week at 89.19 – the largest rise in more than 10 weeks.

- The euro declined 0.4 percent to close the trading week at US$1.2457.

- The British pound fell 1 per cent to US$1.4123.

- The Japanese yen fell 0.7 per cent to 110.144 per dollar, the weakest since January 23, 2018

THE CANADA S&P/TSX AT 4-MONTH LOW:

As can be seen from below chart, Canada’s main stock index – the S&P/TSX – slumped to a four-month low on Friday, with resource and marijuana shares leading broad based declines as higher bond yields pressured global equity markets.

The Toronto Stock Exchange’s S&P/TSX composite index, lost 254.89 points, or 1.61 per cent, on Friday to close at 15,606.03, its biggest drop since May of 2017. All of the index’s 10 main groups ended lower.

PGM CAPITAL COMMENTS & ANALYSIS:

While wage growth may be good for the economy it could spell trouble for the bond market as inflation portends rate hikes, which augur a repricing of fixed income.

The spike in yield of the 10-year note of last Friday, as can be seen from below chart, made traders very nervous and also triggered a sell-off of the equity markets.

Above 5-day chart of the week of January 29, shows that yield has increased 5.7 percent, which is a huge growth.

Inverse relationship Bond yield and Bond price:

As bond prices increase, bond yields fall, which means that the 5.7 procent bond yield increase of last week, means that bond prices has received a huge haircut last week.

Below chart shows the relationship between bond yield fluctuation and bond price fluctuation of a 7 percent coupon bond with par value US$ 1,000.00.

The Stock-market correction of Friday, February 2, 2018:

The stock-market correction of last Friday, looks a whole lot worse than maybe it is because of the fact that we hadn’t had a correction for so long that we all got used to watching this market go up.

It was the biggest single-day percentage decline for the benchmark S&P 500 index since September 2016 and for the Dow since June 2016. Beside this market correction of last Friday, the S&P 500 is still up 3.2 percent for the year.

Marijuana stocks:

Cannabis Stocks Plunge in the week of January 28, as Volatility Returns To Marijuana Markets, as “panic-selling” and concern that companies that had seen ballooning share prices recently are now overvalued.

As can be seen from below chart Canadian cannabis index posts record drop of as much as 26.3%, in the week of January 29, 2018.

Outlook:

We believe that in the wake of tax cuts the risks of a “hard landing” are rising” for the U.S. economy, this due to the fact that the tax cuts will stimulate household spending faster than business investment can improve productivity and, as a result, some of the output growth will have to be accomplished through additional hiring, which will lead to wage inflation.

When inflation picks up as a result of increased consumer spending, it will spur the Federal Reserve to raise interest rates more quickly than expected by markets. Higher interest rates could quickly tighten credit conditions and thus prompt an economic downturn.

Higher interest rates will have a devastating effect on bond prices, the housing markets and the stock market.

A “hard landing” is economist-speak for an economic downturn that comes on suddenly after a surge in economic growth.

The question most analyst are asking them selves is:

How hot will the USA economy gets, and how aggressively the FED will acts to cool it off?

Because the answer of this question, will determine whether the USA will drift into the inevitable future recession or see an economic hard landing in the U.S.

But while rising prices are bad news for consumers, as it takes an ever-increasing amount of money to purchase the same basket of goods and services year after year, inflation can be quite profitable for investors.

The key to making money in an inflationary environment is to hold investments that increase in value at a rate in excess of the rate of inflation.

Precious metals, Oil, metallurgic as well as green commodities, Land, stocks of companies that makes consumer disposable and food have proven to be a good inflation hedge.

We of PGM Capital, your trusted Investment Advisor, are at your service, as the captain of your nest egg, with our best advice for you to protect your self against the dilution of your purchasing power and for you to increase your wealth higher than the inflation rate .

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind that share prices don’t move in a straight line and that Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek