Dear PGM Capital blog readers,

On Thursday January 4, 2018, the Institute of International Finance (IIF) said that global debt rose to a record US$233 trillion in the third quarter of 2017, more than US$16 trillion higher from end-2016.

INTRODUCTION:

According with figures of the Washington DC-based financial industry body, “The Institute of International Finance” which is best known for its periodic and concerning reports summarizing global leverage statistics, total debt had risen by US$16 trillion in the third quarter of 2017, compared to end-2016, to an all time high of US$ 233 Trillion.

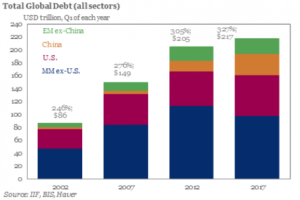

Below chart shows how the total global debt has risen from from Q1-2002 to Q1-2017.

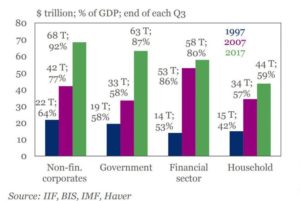

When broken down the Q3-2017, US$ 233 Trillion Global debt by sector we’ll see the following:

- Approx. US$ 63 Trillion in government, debt

- Approx. US$ 58 Trillion debt of the financial sector.

- Approx. US$ 68Trillion debt of the non financial corporates.

- Approx. US$ 44 Trillion debt in the household sectors.

See below chart for details and comparison of the above mentioned breakdown per sector for the years 1997, 2007 and 2017.

According to the IIF, private non-financial sector debt hit all-time highs in Canada, France, Hong Kong, South Korea, Switzerland and Turkey.

PGM CAPITAL COMMENTS & ANALYSIS:

In its annual report, the IIF notes that “a combination of factors including synchronized above-potential global growth, rising inflation, and efforts to prevent a destabilizing build-up of debt have all contributed to the fact that, even as global debt rose to new record highs, the ratio of debt-to-GDP fell for the fourth consecutive quarter as economic growth accelerated.

The Global debt-to-GDP ratio was in Q3-2017 around 318%, nearly 10% below the high set in the first quarter of 2017.

Global Debt rising faster than Global Wealth:

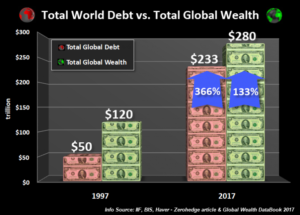

As can be seen from below chart, some nasty dark clouds are forming on the financial horizon as total world debt is increasing nearly three times as fast as total global wealth.

As can be seen from above chart, since 1997, total global debt increased from US$ 50 trillion to US$ 233 trillion compared to the rise in global wealth from US$120 trillion to US$ 280 trillion.

Furthermore, doing simple arithmetic by subtracting DEBTS from ASSETS, global net worth fell from US$70 trillion in 1997 to US $47 trillion in 2017.

By putting the numbers together, right in front of our eyes, we can clearly see that the world is going broke by adding debt. Basically, we erased $23 trillion in Global Net Wealth in the past 20 years.

The Effect of Higher Interest Rates:

The IIF pointed also out that, while global GDP has enjoyed a period of accelerating growth, this may soon come to an end even as debt levels continue to rise. This is due to the fact that the debt pile could act as a brake on central banks trying to raise interest rates, given worries about the debt servicing capacity of highly indebted firms and government.

And speaking of rates, we agree with the IIF that the year 2018, might be a year that will see a rebound in interest rates.

How to Prepare your Portfolio for Rising Interest Rates:

Not all strategies that profit from rising rates pertain to fixed-income securities. Investors looking to cash in when rates rise should consider purchasing stocks of major consumers of raw materials.

The price of raw materials often remains stable or declines when rates rise. The companies using these materials to produce a finished good – or simply in their day-to-day operations – will see a corresponding increase in their profit margins as their costs drop. For this reason, these companies are generally viewed as a hedge against inflation.

Last but not least, before making any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind John Maynard Keynes quote:

The market can remain irrational longer than you can remain solvent.

Eric Panneflek