Dear PGM Capital blog readers,

First of all we herewith want to wish you and your Love-ones a Happy, Prosperous and Healthy New Year 2017.

After a long New Year’s weekend the first day of trading of a short trading week was on Tuesday January 2nd 2017.

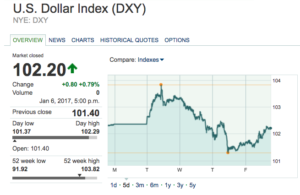

Stocks, bond and USD-Index, started the week mostly sideways as can be seen from below 1-week charts:

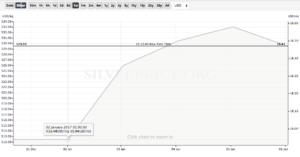

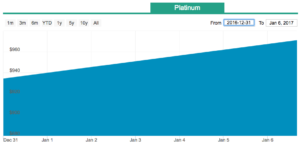

Precious metals on the other hand had a very good start have started the year 2017, with a price appreciation of between 3-5 percent as can be seen from below charts:

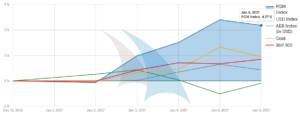

As can be seen from below chart, the PGM Component 50 Index, has appreciated with 4.37 percent during the first week of this year and has also outperformed all mayor world index.

OUTLOOK 2017:

Currently the consensus on Wall Street is, that the US Dollar is going to get stronger in 2017, on expectations of a Trump business-friendly administration.

We of PGM Capital as a contrarian, and based on the following point believe they are dead-wrong:

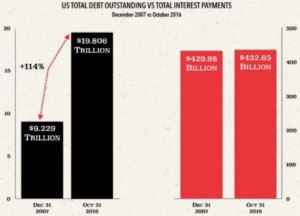

- As can be seen from below chart, the US fiscal picture is very weak as debt continues to grow, and now that interest rates are rising we will see it grow faster.

- Thanks to those persistently falling rates during the period of January 1st 2007 and October 31, 2016, the cost of servicing twice the amount of debt doubled increased only from US$430 billion to US$432 billion per year as can be seen from below chart.

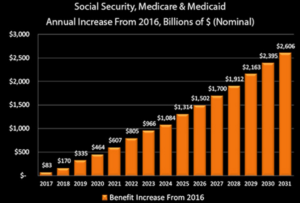

- The costs of unfunded liabilities, like medicate, medicare and social security. are expected to rise exponentially starting 2017, as can be seen from below chart.

- Based on the above, foreign holder of US Treasuries have recently been selling US debt at the highest rate in decades and foreign media are calling the coming US President, “The King of Debt”

- With plans of president elect Mr. Trump, to spend what is predicted to be US$500-US$1,000 billion on a massive infrastructure plan, we do not see any reason 2017 deficit would be any lower than 2016.

After reading the above you should agree with us, that the only way forward regarding the US financial picture is to see a massive increase in US debt – which also means that there will be a massive increase in US Dollars – which consequently will dilute it.

This scenario will make Gold, Silver and other precious metals the excellent contrarian play on the US Dollar’s strength, Wall Street consensus.