Dear PGM Capital Blog reader,

In this weekend’s blog article, we want to discuss some of the most important events that happened in the global capital markets, the world economy, and the world of money, in the week of September 15, 2019, as follows:

- Oil prices soared to the highest level in a decade after attack on Saudi’s Oilfields

- The FED lowers key interest rates with a quarter of a percent.

OIL PRICES SOARED ON THE WORST DISRUPTION EVER:

Oil prices surged more than 15 percent (to their highest level in nearl four months) after the attack, of September 14, on the state-owned Saudi Aramco oil processing facilities at Abqaiq (Biqayq in Arabic) and Khurais in eastern Saudi Arabia. This knocked out more than five percent of global oil supply.

Brent crude futures jumped more than 19 percent to a session high of $71.95 a barrel at the market’s open. The Bloomberg news agency further stated that it was the biggest rise in prices on record.

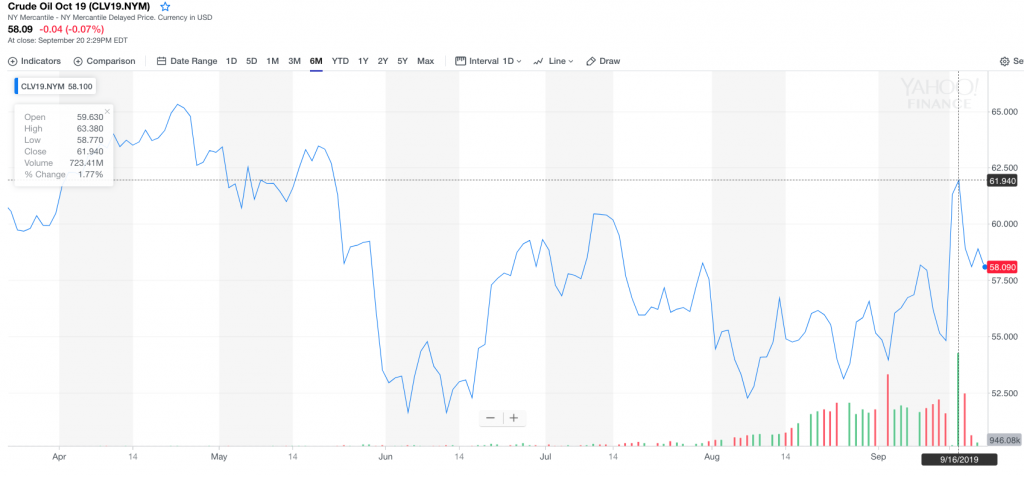

United States crude futures surged more than 15 percent to a session high of $63.34 a barrel. Both benchmarks rose to their highest levels since May. as can be seen from below 6-month chart.

State oil giant Saudi Aramco said the attack cut output by 5.7 million barrels per day and gave no timeline for output resumption.

FED CUT INTEREST RATE FOR THE SECOND TIME THIS YEAR:

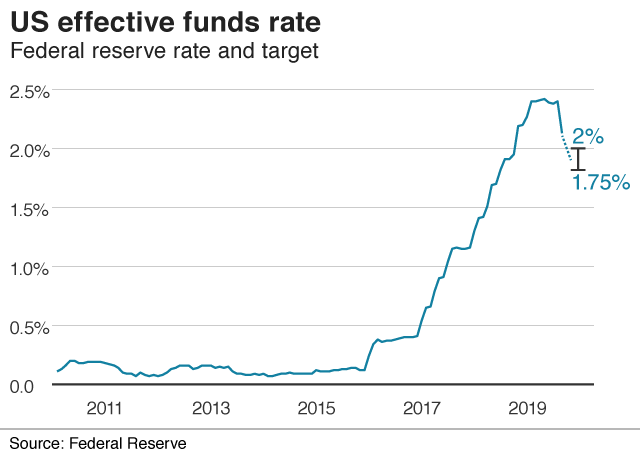

On Wednesday, September 18, the USA Federal Reserve (FED) cut interest rates by a quarter percentage point for the second time since July, as concerns grow about a potential global slowdown.

The federal funds rate, which controls the cost of mortgages, credit cards, and other borrowing, will now hover between 1.75% and 2%.

Policy makers hint at leaving the door open for another rate cut this year if the economy weakens further, reinforcing the message by Fed Chairman Jerome Powell that policymakers will do whatever is necessary to prevent a recession.

Below chart from the FED shows US Federal Reserve benchmark lending rates, as of September 18, after the latest cut.

PGM CAPITAL’s ANALYSIS & COMMENTS:

Saudi Oil Attack and Gold:

Gold rose more than 1% on Monday after an attack on key oil facilities in Saudi Arabia inflamed worries over the stability of the Middle East, driving investors to seek refuge in assets seen as a haven from risk.

A twenty percent bounce in oil prices in response to the attack also raised concerns over a potential rise in inflationary pressures, against which gold is often perceived as a hedge.

This reaction is driven by two factors:

- That people are treating gold as some sort of inflation hedge in this environment.

- And that the most important factor is the increase in geopolitical tensions, (with) uncertainties related to this event, people are seeking shelter in the gold market.

Below chart shows the increase of gold price after the Saudi’s Oil field attack.

Rates Cut and Gold:

Inflation is often understood as being the rise of the prices of goods and services over time. However, this is actually the symptom of inflation i.e price inflation. Inflation is the expansion of the supply of money in an economy. It results in having more currency competing for the relatively same amount of goods and services thus pushing up prices.

Today, currencies can be created in large quantities by banks and governments at a much faster rate than for goods and services are produced and brought to the market. That is why prices rise steadily over time.

Below chart shows the expansion of the money supply in the USA.

Central Banks around the world are lowering rates and increasing the money supply to stimulate their respective economies.

This incredible expansion of the money supply has leaked into world economies resulting in price inflation. Hot money from QE has also flowed into other countries creating asset bubbles in the property market. This is why we continue to see rising prices in goods and services.

Unfortunately, for the most of us, our incomes do not rise in tandem.

Precious metals are often regarded as a hedge against inflation. They preserve purchasing power for long periods of time. When measured against gold, the prices of commodities such as oil are relatively stable over long periods of time when compared with the prices of commodities denominated in a fiat currency like the US dollar.

Below chart shows the increase of the price of gold, during the past 52 weeks since central banks all over the world are lowering their key rates and increasing the money supply.

Besides precious metals, stocks of mining companies- and producers of consumers products, are also excellent inflation hedges, for which on top of it, most of them are dividend aristocrates. This would mean investors profit from their increasing stock prices as well as a yearly increase of their dividend payout.

Since money loses it’s purchasing power during an inflationary phase investors should avoid having bonds and high cash balances.

Disclosure:

We own precious metals as well as shares of mining companies and dividend aristocrates in our personal portfolio.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek