Dear PGM Blog readers,

In this weekend’s blog edition we want to discuss some of the most important events that happened in the global capital markets, the world economy and the world of money in the week of January 30, 2017:

- Diageo reports 28 percent profit increase and hike dividend.

- Reckitt & Benckiser in talk to buy Mead Johnson.

- The US-Dollar Index dips below 100.

DIAGEO REPORTED 28 PERCENT INCREASE IN PROFIT:

On Thursday, January 26, 2017, Diageo PLC (DGE.L), the maker of Johnnie Walker whiskey and Smirnoff vodka said operating profit hit £2.06 billion ($2.6 billion) in the six months ended 31 December 2016.

The company also saw volumes grow of 2 percent on an organic basis from the same period last year, with organic sales in its biggest market of North America up with 3 percent.

Diageo also raised its interim dividend to 23.7 pence per share, a hike of 5 percent, to be paid on April 11, for shareholders on record on February 24, 2017. The Ex-dividend date is set on February 22, 2017.

RECKITT & BENCKISER TO BUY MEAD JOHNSON:

On Thursday, February 2, 2017, Reckitt Benckiser Group Plc (RB.L), – best known for its Lysol cleaners, Durex condoms, Nurofen tablets and Scholl footcare products – said that it is in advanced talks to buy Mead Johnson Nutrition Co (NYSE: MJN) in a US$16.7 billion deal that would take the British consumer goods maker into the baby formula market and boost its business outside of Europe.

About Mead Johnson:

Mead Johnson, the world’s No. 2 infant formula maker with its Enfamil brand, was spun off from drugmaker Bristol-Myers Squibb (NYSE: BMY) in 2009.

It has been seen as a possible takeover target due to its big presence in China and Latin America, regions with fast-growing populations, as well as in the United States.

As can be seen from below chart the shares of Mead Johnson jumped on the announcement with 26 percent at US$ 88.00 on Thursday in New York.

In London, Reckitt shares were up 4 percent at 7,102 pence, as enthusiasm over the deal’s potential to lift profits overshadowed questions around price and strategy for going up against tough rivals Nestle (NESN.S) and Danone (DANO.PA).

USD INDEX DIPS BELOW 100:

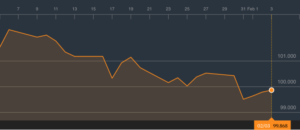

As can be seen from below chart, on Tuesday January 31, the USD Index weakened to the lowest levels in more than two months as concerns of drastic changes to the global trade regime by President Donald Trump caught investors concerned about prospects of tit-for-tat retaliations on imports and export.

Above chart shows how, the U.S. dollar index, which measures the greenback against a basket of currencies, fell below the psychological important 100 point mark for the time since mid-November last year.

PGM ANALYSIS & COMMENTS:

Diageo:

In a statement, Diageo said, that the weakening of the pound is estimated to favorably impact net sales for its fiscal year by approximately £1.4 billion and operating profit by approximately £460 million.

The spirits maker reiterated its medium-term guidance of mid-single digit top line growth and 100 basis points of organic operating margin improvement in the three years ending 30 June 2019.

As can be seen from below 10-year chart, the shares of the company has appreciated with approx. 115 percent, while its dividend payout, in the same period has increased with approx. 85 percent.

Based on the company’s fundamentals, we have BUY rating on the shares of the company.

Reckitt & Benckiser – Mead Johnson:

Mead Johnson, has been seen as a possible takeover target due to its big presence in China and Latin America, regions with fast-growing populations, as well as in the United States.

Reckitt has a long history of successful deals, but its interest in consumer health products, such as over-the-counter medicines, had led to speculation about other potential targets.

In a statement Reckitt said it expected to finance the deal through cash and borrowings.

As can be seen from below 10-year chart, the shares of the company has appreciated with approx. 175 percent during the last 10 year, while it has increased its dividend payout with 167 percent in the same period.

Based on the company’s fundamentals, we have a STRONG BUY rating on the shares of the company.

The USD-Index:

Trump addressed U.S. manufacturing executives with a repeated promise to impose a border tax on firms that import products into the United States after moving American factories overseas and announced the country had abandoned the Trans-Pacific Partnership trade pact among a dozen nations.

Trump’s promises of tax cuts and higher federal spending continue to hold the market’s attention, but details are sparse.

Trump also said, he would start talks with Mexico and Canada to renegotiate the North American Free Trade Agreement (NAFTA).

The above mentioned protectionism policies of Trump, are making investors nervous and their hope is that his tax cut policies could perhaps save the day for them.

Until next week.

Yours sincerely

Eric Panneflek