Dear PGM Capital, blog readers

In this weekend blog edition, we want to discuss some of the most important events that happened in the global capital markets, the world economy and the world of money in the week of March 6, 2017:

- Oil Slumps to the lowest level of 2017.

- ECB leaves key interest rates unchanged.

- The USA Economy created 235,000 non-farm jobs in February.

OIL SLUMPS TO THE LOWEST LEVEL OF 2017:

In the week of March 6, Crude Oil slumped the most in more than a year after USA government data showed, crude stocks in the United States, the world’s top oil consumer, swelled by 8.2 million barrels last week to a record 528.4 million barrels, as a sign that production cuts from OPEC and other exporters have not been enough to reduce U.S. supplies.

As can be seen from below chart the price of WTI slumped from US$ 53.73 a barrel, on Tuesday, March 7, to US$ 48.39 a barrel, at the close of the market on Friday March 10, a decline of US$ 5.34 a barrel or almost 10 percent in the week of March 6.

Saudi Arabia’s Oil Minister Khalid Al-Falih said in Houston on Tuesday, March 7, that global supplies have been slower to decline than OPEC and its partners expected, leaving the door open for an extension of cuts that started in January.

ECB LEAVES KEY RATE UNCHANGED:

On Thursday, March 9, at the end of its policy meeting, the European Central Bank (ECB) has left interest rates and its quantitative easing program unchanged.

The decision came against a backdrop of inflation reaching the bank’s goal of just under 2 percent for the first time since early 2013.

Mario Draghi, ECB president, who was under pressure from the council’s hawks, stepped back from the prospect of more rate cuts.

Highlights:

- ECB main rate remains at 0.00%, deposit facility at -0.40%

- QE bond buying program continues till at least end of 2017

- Monthly QE due to drop from €80 billion to €60 billion from April as previously announced

- ECB keeps long-term inflation forecasts unchanged

- Draghi says “no signs yet of a convincing upward trend in underlying inflation”

- Draghi takes more hawkish tone on monetary policy

STRONG FEBRUARY USA JOBS REPORT:

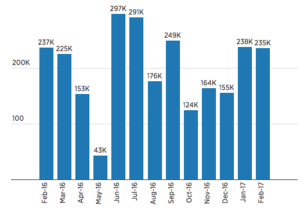

The USA Bureau of Labor Statistics reported on Friday, March 10, that the country’s economy added 235,000 non-farm jobs during the month of February, compared with forecasts of 200,000.

Below chart shows the non-farm jobs creation during the last 12 months.

Highlights:

- Average hourly earnings increased by a healthy 2.8 percent on an annualized basis.

- Construction led the way, growing by 58,000, the most in almost a decade, while manufacturing also posted strong gains with 28,000 new jobs.

- The mining sector added 7,700 jobs last month.

- Retail sector employment fell 26,000, the biggest decline since December 2012.

Source: US Bureau of Labor Statistic

PGM CAPITAL ANALYSIS & COMMENTS:

Crude Oil Slump:

Given that we do expect OECD oil stocks to decline substantially this year helped by the large OPEC cuts and robust global demand growth, we consider the recent drop in crude oil prices to be a good buying opportunity.

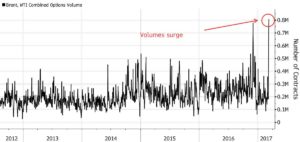

Options traders also reflected hopes that prices would recover. As can be seen from below chart, in total, options equivalent to more than 800 million barrels of crude oil exchange hands on Thursday March 9, an amount that is well more than half the total outstanding net long spec positions.

According to Bloomberg, September Brent contracts were among the most active, with record call volumes on bets that prices would hit US$60 and US$70 a barrel.

On the other-hand, U.S. drilling has picked up, with producers planning to expand crude production in North Dakota, Oklahoma and other shale regions, this will increase the oil supply, which might be bearish for Crude Oil Prices.

ECB Meeting:

The Thursday March 9. meeting comes on the second birthday of the ECB’s quantitative easing program.

In March of 2015, the ECB in order to stimulate the Economies of the Eurozone countries, started buying sovereign bonds and have since extended the program to include corporate bonds.

Below chart shows, how the ECB’s QE program, has swelled its balance sheet since the start of its QE program in March of 2015.

Although the QE program has risen the headline measure of inflation in the Eurozone, core inflation, which excludes energy and food remains at 0.9 percent as can be seen from below chart.

A faster than expected rise in inflationary pressures over the last month means that Mario Draghi will have to defend his insistence that price pressures are under control.

Meanwhile the eurozone’s growth prospects are also picking up. Quarterly GDP expanded by 0.4 percent at the end of last year.

USA Job report:

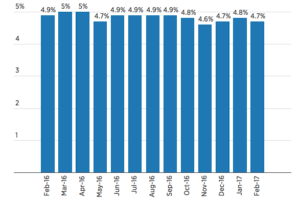

Based on the Friday’s job report, the jobless rate in the USA, dipped to 4.7 percent from 4.8 percent and the country’s labor force participation rate, or the share of working-age Americans who are employed or at least looking for a job, increased one-tenth of a percentage point to 63 percent in February, the highest level since March 2016.

With the labor market near full employment, wage growth could speed up as companies are forced to raise compensation to retain employees and attract skilled workers. A proxy for take-home pay rose a solid 0.5 percent in February.

The annual wage increase is close to the 3 percent to 3.5 percent range that economists say is needed to lift inflation to the Fed’s 2 percent target. Inflation is already firming, in part as commodity prices rise.

A tighter labor market, rising inflation, together with stock market boom and strengthening global economy, has left some economists expecting that the Fed could increase rates much faster than currently anticipated by financial markets.

Based on the above, we expect the USA FED, to increase key interest rates at the end of the FOMC meeting of coming March 15.

Until Next week

Eric Panneflek