Dear PGM Capital blog readers,

In this weekend blog edition, we want to discuss some of the most important events that happened in the global capital markets, the world economy and the world of money, in the week of August 14, 2017:

- Palladium at 16.4-year high.

- Ping-An Insurance reported Block buster earnings and hikes it dividend with 150 percent.

PALLADIUM AT 16.5-YEAR HIGH:

Palladium is a chemical element with symbol Pd and atomic number 46 and it an extremely rare, silver-white Precious Metal with a relatively low melting point and low density.

Palladium, platinum, rhodium, ruthenium, iridium and osmium form a group of elements referred to as the platinum group metals (PGMs). These have similar chemical properties, but palladium has the lowest melting point and is the least dense of them.

As a naturally white Precious Metal, Palladium will keep its brilliant color for life.

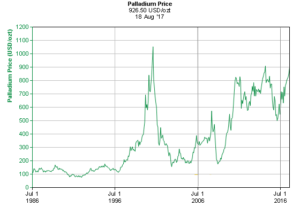

As can be seen from below chart, in the week of August 14, the price for Palladium for September delivery rose US$ 30.50, or 3.41%, to close the week at US$$924.50 an ounce, which was the highest settlement since February 2001

PING AN INSURANCE GROUP REPORTED BLOCK BUSTER EARNINGS:

On Friday, August 18 in the morning in Hong Kong, Ping An Insurance, (2318.HK) China’s second largest insurer in terms of market value, reported it H1-2017 financial results.

Highlights:

- Net profit in H1-2017, reached to 43.4 billion yuan (US$6.5 billion), an increase of with 6.5 percent compared with the first six months of 2016.

- After excluding a 9.5 billion yuan gain from internal restructuring in the first half of 2016, profit growth was 38.8 percent year on year.

- The insurer’s total premium income was 341.39 billion yuan in the first half of 2017, compared with 256.87 billion yuan in the year-ago period.

- Equity attributable to shareholders of the parent company amounted to 425.9 million yuan, up 11 percent from the beginning of the year.

- The company proposed an interim dividend of 0.5 yuan per share for the six months ended June 30, 150 percent higher that the same period last year.

- The payment date is set for October 16, 2017, for which the ex-dividend date is set for September 4.

Based on the news Ping An shares surged as much as 3.3 percent Friday to an all time high of HKD 60.20 a shares, as can be seen from below chart.

On July 26, 2017, the company was named for the fourth time as “Most Honored Company” in Asia and took the first place in almost all eligible categories for the insurance sector.

PGM CAPITAL ANALYSIS & COMMENTS:

Palladium:

Over 50 percent of the Palladium supply is used in the automotive industry to create catalytic converters, which reduce the amount of carbon monoxide emitted from automobiles.

Palladium is also used in jewelry, dentistry, watch making, blood sugar test strips, aircraft spark plugs, surgical instruments, and electrical contacts. Palladium is also used to make professional transverse (concert or classical) flutes.

As a commodity, palladium bullion has ISO currency codes of XPD and 964.

The Russian nickel and palladium producer Norilsk Nickel (MNOD.L) said earlier this week that it expects consumption of palladium to reach an all-time high of 10.8 million ounces this year.

On our advise several of our clients own physical Palladium in their portfolio, based on the pattern of the all time Palladium chart, we can expect a correction in the short term, due to this we advised our client to take some profit by trimming their Palladium holdings and wait for the correction to increase the Palladium holdings in their portfolio.

Ping An:

As can be seen from below chart, the semi annual results reported on Aug 17, 2017, by the company, of HKD 2.43 per share, exceeded the HKD 2.29 per share expectation of the analysts covering the company, which also exceeded last year’s results for the same period by 6.58%.

The company’s semi H1-2017 revenues were HKD 503.14billion, and much better than the HKD 310.99billion estimated by the analysts covering the company, as can be seen from below chart.

It is also worth mentioning, that the H1-2017 revenue was 106.5 percent above the prior year’s period results.

As can be seen from below chart, Ping An Insurance Group Co. shares have soared almost 56 percent this year.

Based on the company’s business model, strong balance-sheet, its ability to increase its dividend Year-Over-Year, and the fact that the company is able to grow its earnings as well as its revenues Year-Over-Year with triple digit, we have a STRONG BUY rating on the shares of the company.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind that the market can remain irrational longer, than you can stay solvent.

Yours sincerely,

Eric Panneflek