Dear PGM Blog reader,

In this weekend blog article, we want to take the opportunity to discuss with you, why Investing in Anheuser-Bush Inbev, can be lucrative for value investors.

INTRODUCTION:

Beer is one of the oldest and most widely consumed alcoholic drinks in the world, and the third most popular drink overall after water and tea.

The global beer market is characterized by leading brewing groups such as Anheuser-Busch InBev (AB InBev), SAB Miller, Heineken and Carlsberg.

Anheuser-Busch InBev SA/NV (abbreviated as AB InBev) is a Belgian-Brazilian multinational beverage and brewing company with global headquarters its headquarters is located in Leuven, Belgium, where the brewery roots can be traced back to 1366. About 155,000 people are employed by the company.

The company’s additional main offices are located in São Paulo, New York City, London, St. Louis, Mexico City, Johannesburg and others.

The company has operations in 25 different countries through six geographic regions, had in 2017, a global production volume of 613 million hectoliters.

AB InBev manages a portfolio of well over 200 beer brands and has leading market positions in many famous world’s beer markets

By the end of 2017, the company had 182,915 employees world wide, and reported a FY-2017 revenue of 56.44 billion US-Dollars, with a operating income of 17.15 billion US-Dollars.

Anheuser-Busch InBev SA/NV is a publicly listed company, with its primary listing on the Euronext Brussels under the symbol ABI. It has secondary listings on Mexican Stock Exchange under the symbol ANB, Johannesburg Stock Exchange under the symbol ANH and New York Stock Exchange under the symbol BUD.

HISTORY:

The original AB InBev was formed through successive mergers of three international brewing groups completed in 2008: Interbrew from Belgium, AmBev from Brazil, and Anheuser-Busch from the United States. In October 2015, Anheuser-Busch InBev announced a successful all-cash bid to acquire multinational competitor SABMiller for £69 billion (US $107 billion).

Shareholders for both companies approved the merger on 28 September 2016. The deal closed on 10 October 2016.

The new entity has approximately 500 beer brands in over 100 countries.

On July 21, 2017, Anheuser-Busch InBev continued its investment in the non-alcohol beverage sector with the purchase of energy drink company Hiball.

On July 21, 2017, Anheuser-Busch InBev continued its investment in the non-alcohol beverage sector with the purchase of energy drink company Hiball.

PGM CAPITAL ANALYSIS & COMMENTS:

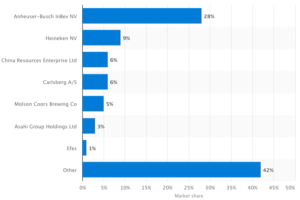

Below chart of the statistic of the beer market share by country in 2015, shows that in that year, Anheuser-Busch InBev has the largest beer market share in the world, controlling about 28 percent of the beer volume sales.

Second and third places, Heineken NV and China Resources Enterprise accounted for 9 and 6 percent of the beer market share, respectively.

Below chart shows the 5 beer makers that own more than 50% of the world’s beer market.

World Cup 2018:

Budweiser, one of the key brands of Anheuser-Busch InBev, is the global beer sponsor of the sporting event.

Partnering with such a massive tournament, which boasts an audience of over 3.2 billion, should bode well for the company.

In this regard, AB InBev launched its biggest commercial campaign called “Light Up the FIFA World Cup.”

This campaign has been activated in more than 50 countries, which includes not only those where the brand already has a significant presence such as China, Brazil, the U.K., and Russia, but also new markets which include Colombia, Peru, Ecuador, Australia, and Africa.

The company expects growth to accelerate in the remainder of the year, particularly in the second half, with the World Cup being one of the driving factors.

Outlook:

As can be seen from below 18-year chart, since 2014, the shares of the company, are consolidating, this although its market share growth, and subsequent revenue and profit growth.

Above chart shows that over the past 17 years the shares of the company has appreciated from Euro 16.09 a share on December 31 2000 to Euro 84.59 on Friday July 14 2018, an increase of Euro 68.50 or 425 percent.

In same period the payout dividend of the company increased from Euro 0.21 a share in 2001 to Euro 3.60 a share in 2017 an increase of the dividend of 1,614 percent. Based on the closing price of the shares of the company on Friday June 15, the shares of the company have a dividend yield of 4,69%.

Based on the above and the company’s strong balance sheet, forward P/E ratio 15.19, we have initiated the coverage on the shares of the company with a BUY rating.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind that; share prices don’t move in a straight line and that Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek