Dear PGM Capital Blog readers

On Wednesday, March 20, at press conference at the end of the FOMC meeting, Fed Chairman, Mr. Jerome Powell, announced that the FED will leave interest rates unchanged, foreseeing no more hikes this year.

INTRODUCTION:

After a two-day meeting, monetary policymakers voted unanimously to keep the US interest rate range between 2.25%-2.5%: a widely expected move after officials stressed that they would be “patient” and flexible”before deciding to adjust borrowing costs again.

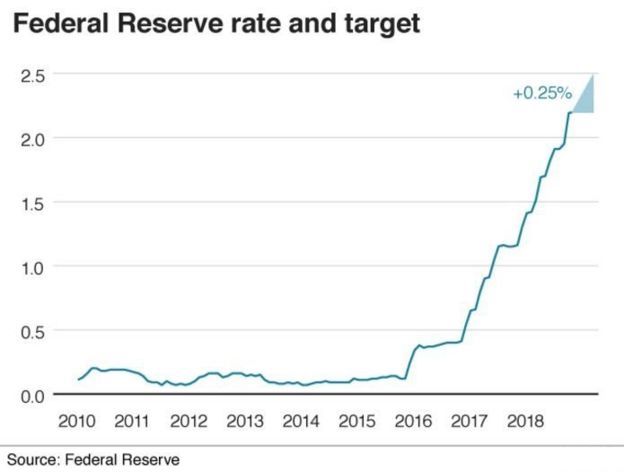

Below chart shows the Fed Fund rate in the period of 2010 up to now.

Fed members changed their outlook for 2019 from the two increases predicted in December to no movement.

The central bank warned that “growth of economic activity has slowed from its solid rate in the fourth quarter”.

It said:

“Recent indicators point to slower growth of household spending and business fixed investment in the first quarter.”

- US economic growth continues to slow.

- US jobs shock as growth slows.

Fed chairman Jerome Powell maintained his stance that the central bank would continue to be “patient”, telling a press conference:

“It may be some time before the outlook for jobs and inflation calls clearly for a change in policy.”

PGM CAPITAL’s ANALYSIS & COMMENTS:

The big questions, most investors, are asking them selves is, shall we cheer the fact the the FED, is pausing its interest rate increase cycle or, it is the FED giving us a warning sign.

Below phrases from the speech of Mr. Powell, might give us a clue, for what the FED sees ahead for the USA and global economy.

Mr Powell said:

“That there was a positive outlook for the rest of the year, with the unemployment rate under 4% and inflation below the central bank’s 2% target”.

“We are also very mindful of what the risks are, which include slower global growth and no resolution on either Brexit or US-China trade talks”.

The Fed also said that it will slow the monthly reduction of US Treasury bonds it holds from US$ 30billion to US$15 billion from May onwards ending in September.

We believe that the main reason for FED to pause hiking interest rates is, that they are getting just a little more wary about economic prospects.

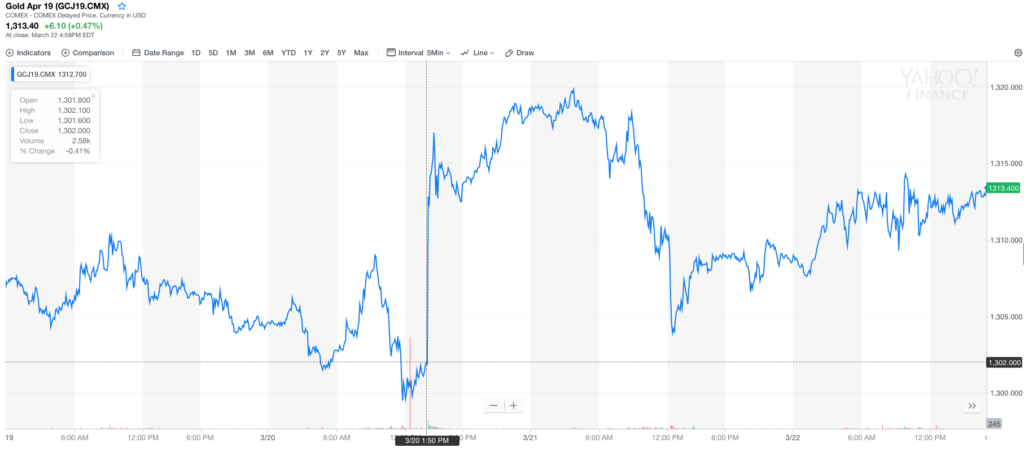

Based on this, the price of gold jumped immediately after the FED announcement as can be seen from below chart.

Markets drop sharply as fears of global slowdown intensify:

Financial markets around the world have dropped sharply amid mounting fears of a slowdown in the global economy, after eurozone factory output fell at the fastest rate in almost six years.

New York slumped, with the Dow Jones industrial average closing down 460 points, or 1.8%, while the FTSE 100 dropped by 2% and markets across Europe also recorded steep losses.

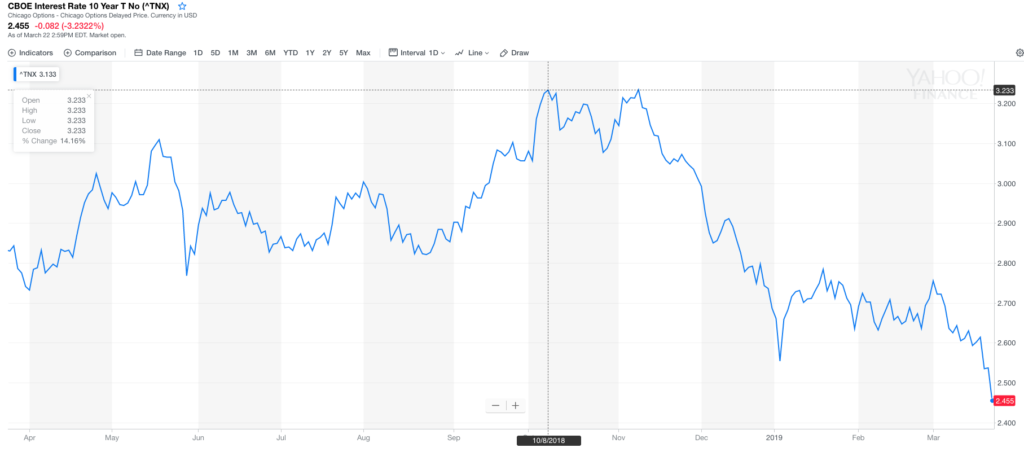

The FED speech and worst than expected industrial production figures out of Europe has raised the fear of a coming recession in Europe and the USA, based on this beside gold, investors flee into the fixed income market and sending the yield of the US 10-year note to its lowest level in 1 year, as can be seen from below chart.

We believe that the world economy is at a turning point in the broadest sense of the word, and the years 2019 and 2012, might be the years of the big shift of wealth.

Below quote of Dave Ramsey, might be applicable.

Until next week

Yours sincerely,

Eric Panneflek