Dear PGM Capital Blog readers,

In this weekend’s blog article, we want to elaborate on the chances that the COVID-19 pandemic might trigger a debt crisis.

INTRODUCTION:

The public debt is how much a country owes to lenders outside of itself. These can include individuals, businesses, and even other governments. The term “public debt” is often used interchangeably with the term sovereign debt.

Public debt is the accumulation of annual budget deficits. It’s the result of years of government leaders spending more than they take in via tax revenues. A nation’s deficit affects its debt and vice-versa.

Governments tend to take on too much debt because the benefits make them popular with voters. Increasing the debt allows government leaders to increase spending without raising taxes. Investors usually measure the level of risk by comparing debt to a country’s total economic output, known as gross domestic product (GDP). The debt-to-GDP ratio gives an indication of how likely the country can pay off its debt.

- Public debt allows governments to raise funds to grow their economy or pay for services.

- Politicians prefer to raise public debt rather than raise taxes.

- When public debt reaches 77% of GDP or higher, the debt begins to slow growth.

THE COVID-19 PANDEMIC EFFECT ON PUBLIC DEBT:

In addition to its public health consequences, the coronavirus pandemic is likely to lead to an increase in government debt around the world.

The global economy is projected to shrink 3% this year – a downturn that would likely cause tax revenues to fall – even as governments in the United States, Europe and elsewhere spend trillions of dollars on emergency relief measures to try to contain the damage.

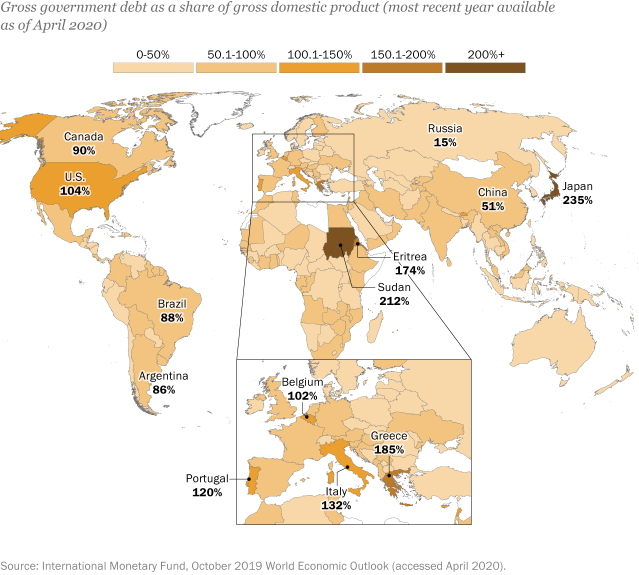

For some governments, the debt incurred on COVID-19 relief will add to the considerable red ink already on their ledgers before the pandemic arrived. Leading up to the crisis, government debt accounted for a large chunk of gross domestic product – or exceeded it – in dozens of countries, including some of the world’s biggest economies, according to data published by the International Monetary Fund (IMF) in October 2019.

Below global map of the IMF shows the debt to GDP on our planet as of April 2020.

Japan is not the only major economy where government debt exceeded or nearly equaled GDP before the outbreak. In 2018, debt accounted for 132% of GDP in Italy, 104% in the U.S., 98% in France, 90% in Canada and 87% in the United Kingdom. Along with Japan, all of these countries are part of the Group of Seven, a forum for the world’s leading industrial economies. In the remaining G7 member, Germany, debt accounted for 62% of GDP in 2018.

Other large economies where debt accounted for a comparatively large share of GDP in 2018 include Spain (97%), Brazil (88%) and Argentina (86%).

PGM CAPITAL ANALYSIS & COMMENTS:

While the economic fallout of the lockdown measures currently taken to contain the COVID-19 pandemic around the world is doubtlessly severe, many experts are hoping that economic activity will return to normal relatively quickly once the virus is contained and countries resume business.

Assuming that aid packages prove effective in helping affected businesses and individuals through the lockdown period, one thing will surely remain once the pandemic is contained or a vaccine is found: a mountain of debt.

All over the world government are announcing trillions of dollars aid package to limit the immediate damage inflicted by the lockdown.

While quick relief was certainly necessary to keep businesses afloat and help individuals who just lost their job, the “Coronavirus Aid Relief” does come with side effects of soaring debt levels around the world.

For example, the U.S. budget deficit could soar to a record US$3.8 trillion in the fiscal 2020, which equals a whopping 18.7 percent of the country’s GDP. Other countries have passed similar aid packages over the past few weeks.

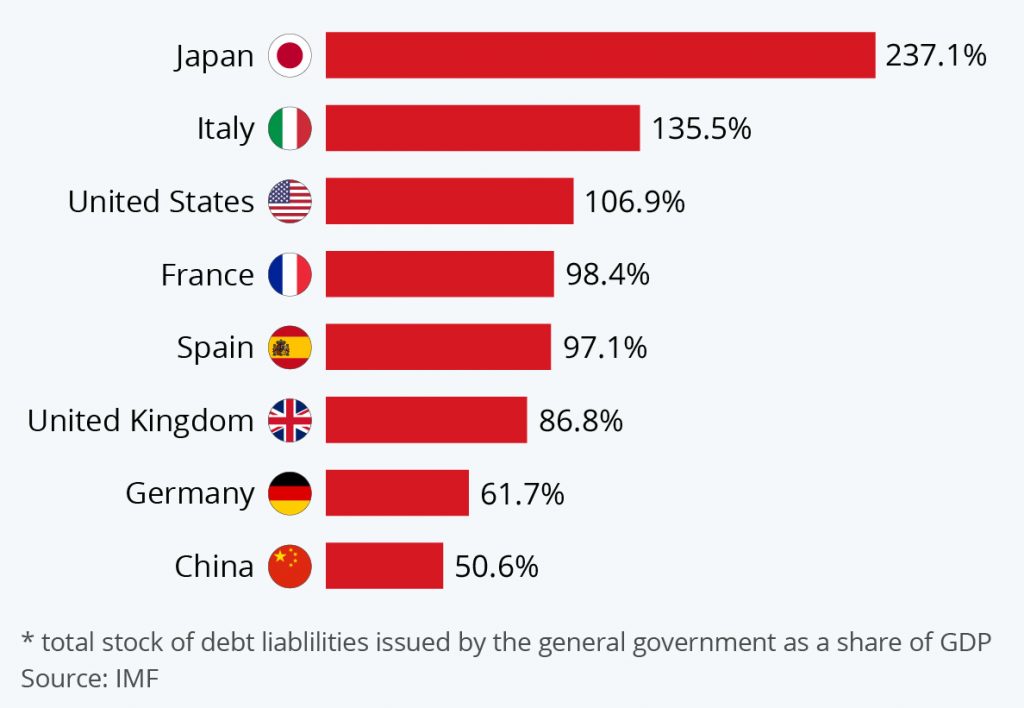

Below chart of the IMF shows, debt levels were already very high in many countries before the coronavirus pandemic hit.

According to the IMF, Germany and China are among the countries better prepared to stomach the additional spending made necessary to keep their economies afloat. Germany in particular has been known for its (widely criticized) austerity in recent years, taking pride in reaching “the black zero”, i.e. a balanced budget for several years.

On Friday, June 19, official data showed that UK borrowing exploded to £103.7billion over April and May’s lockdown, as debt exceeded 100 percent as a percentage of GDP in May for the first time in 57 years.

Debt crisis and Inflation:

Economists and analysts are openly debating whether the massive financial support that is being injected into the world economy and the resulting unprecedented levels of debt governments are taking on will fuel inflation down the line.

A COVID-19 inflation might be triggered as follows:

When the public health crisis caused by COVID-19 comes to an end, people will rushing to stores and restaurants and resume buying, – using newly created COVID-29 stimulus money – with lots of pent-up demand after months in quarantine. The amount of money in circulation, chasing the same amount of goods and services, will put an upwards pressure on prices.

Meanwhile, a wave of shutdowns will leave shortages across the economy: factories that have not been producing, crops rotting in fields, international supply chains freezing up as nations turn inward and globalization reverses.

When those trends run head-on into a huge increase in deficits and money creation by central banks aimed at containing the economic crisis, too much money will be sloshing around the economy relative to what is being produced, and prices will rise.

When inflation picks up, it will be up to central banks to decide how much of it to tolerate. Will they be willing to overshoot their current inflation targets of about 2% per year?

After the COVID-19 pandemic, governments may decide to push central banks to tolerate above-average inflation. It may be the easiest way for them to deal with COVID-19 spawned debt.

In this case, your portfolio must be a hedge against inflation, for which we expect food inflation should be the highest concern.

PGM Capital is at your service as your, Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management, as the captain of your arc in these turbulent times.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek