Dear PGM Blog reader,

In this weekend blog article we want take the opportunity to discuss with you the fact that on Wednesday, April 18, the International Monetary Fund (IMF) sound the alarm that the world’s debt has reached 164 Trillion US-Dollars, which is deeper than the debt at the height of the financial crisis.

SUMMARY OF THE IMF REPORT:

According with the above mentioned report of the IMF, global debt is now more than twice the size of the value of goods and services produced every year and at 225 percent of global gross domestic product, it is now 12 percentage points higher at the peak of the 2008 financial crisis, when global debt-to-GDP peaked at 213.

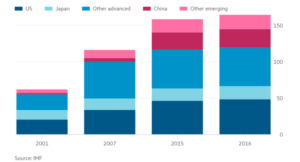

Below chart shows the total global debt in 2001, 2006, 2011 and 2016.

The fund said there was now an urgent need to reduce the burden of debt in both the private and public sectors to improve the resilience of the global economy and provide greater firefighting capability if things went wrong.

In its latest Fiscal Monitor published at its Spring meetings in Washington the IMF said:

“Fiscal stimulus to support demand is no longer the priority,”

The fund was concerned that private sector debts make the global economy more vulnerable to a new financial crisis started by “an abrupt deleveraging process” where borrowers all tighten their belts simultaneously, sending the economy into a nosedive.

The IMF said:

“In the event of a financial crisis, a weak fiscal position increases the depth and duration of the ensuing recession, as the ability to conduct countercyclical fiscal policy is significantly curtailed”

With the global economy growing strongly, the IMF recommended countries to stop using lower taxes or higher public spending to stimulate growth and instead try to reduce the burden of public sector debts so that countries have more leeway to act in the next recession.

Echoing its warning from April 2017, The IMF again noted it is was concerned that private sector debts make the global economy more vulnerable to a new financial crisis started by “an abrupt deleveraging process” where borrowers all tighten their belts simultaneously, sending the economy into a nosedive.

PGM CAPITAL ANALYSIS & COMMENTS:

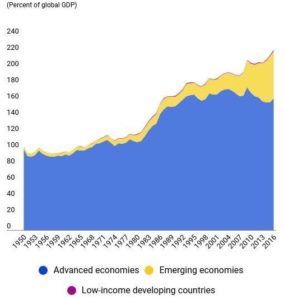

As we can see from below chart, while advanced economies are responsible for most global debt, in the last ten years, emerging market economies have been responsible for most of the increase.

When looking at the big picture, needless to say it’s all about the US, China and Japan: these three countries alone accounted for half of the US$164 trillion total in global public and private sector debt. And speaking of China, its debt surged from US$1.7 trillion in 2001 to US$25.5 trillion in 2016, and was described by the IMF as the “driving force” behind the increase in global debts, accounting for three-quarters of the rise in private sector debt in the past decade.

The USA:

The IMF singled out the Trump administration’s tax cuts for criticism, since they left the US with a deficit of 5 percent of national income into the medium term and a persistently rising level of debt in GDP.

In a statement the IMF said

“In the United States fiscal policy should be recalibrated to ensure that the government debt-to-GDP ratio declines over the medium term. This should be achieved by mobilising higher revenues and gradually curbing public spending dynamics, while shifting its composition toward much-needed infrastructure investment.”

As can be seen from below chart, among the advanced economies, only the USA expects an increase in debt-to-GDP ratio in the coming five years.

However, there is no sign that the Trump administration has any intention of increasing taxes as the IMF recommends and, instead, hopes that faster growth will supply the necessary revenues, something the fund and the US fiscal watchdog thinks is highly unlikely.

Conclusion:

The report also judges that the global banking system is stronger now than it was at the time of the crisis. But it adds that reforms need to continue.

The debt problem is not limited to advanced economies, with middle-income countries racking up borrowing higher than that which led to the debt crises of the 1980s.

The IMF recommended that countries raise taxes and lower public spending to decrease annual borrowing and get the burden of debt on a firmly downward path now that there is no need for fiscal stimulus.

The few exceptions to that advice included Germany and the Netherlands, which the IMF said had “ample fiscal space” to boost public investment in infrastructure and enhance the long-term resilience of their economies.

Until Next week.

Yours sincerely,

Eric Panneflek