Dear PGM Capital Blog readers,

In this blog article we want to elaborate on the seasonality effect on crude oil prices.

INTRODUCTION:

Seasonality plays a key role in influencing crude oil prices.

Based on the fact that over 80 percent of the Oil consumption happens on the Northern Hemisphere, for which on top of this the USA is the biggest Crude Oil consumer on the planet, crude oil prices tend to rise in August due to the summer driving season, which results in a rise in gasoline demand.

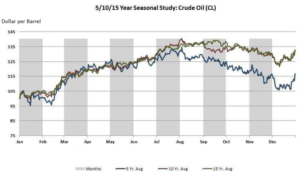

The hurricane threats in the Gulf of Mexico are also priced in during this period. But, towards mid-September and October, crude oil prices tend to peak out as can be seen from below chart.

On the other hand, as can be seen from below 30-year Crude Oil Seasonal chart, crude oil prices tend to fall during early October due to sluggish demand in the fall, and rise again in December as a consequence of the start of the heating season.

Based on the above price analysis of crude oil, a projection of it suggests that crude oil prices generally peak between September and October.

Than prices start to make lower highs between October and November. Finally, they hit the bottom by December, before they start rising again.

PGM CAPITAL & ANALYSIS:

Seasonality influences crude oil prices under normal supply and demand conditions. But compared to geopolitical tensions, oil glut, economic slowdown, or a financial crisis, the seasonality factor could have a minor effect.

Memorial Day:

Coming Monday, May 28, they celebrate Memorial Day in the USA. Historically, investors consider the period between Memorial day and Labor day in the USA as the Cooling and driving season for that country in particular and for developed economies in the Northern Hemisphere in general.

It also marks the unofficial start of the summer vacation season in the Northern Hemisphere.

Labor Day:

Labor Day in the United States is the first Monday in September, which honors the American labor movement and the contributions that workers have made to the strength, prosperity, laws and well-being of the country.

It is the Monday of the long weekend known as Labor Day Weekend and it is considered the unofficial end of summer in the United States and the Northern Hemisphere.

Why did Oil Prices fall on Friday May 25, 2018:

Oil prices plunged in early trading on Friday, May 25, on news that OPEC and its partners, including Russia and Saudi Arabia, are considering a loosening of their production limits, perhaps adding as much as 1 million barrels per day to the market.

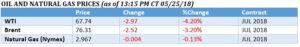

Both WTI and Brent fell by more than 3 percent Friday morning as can be seen from below table.

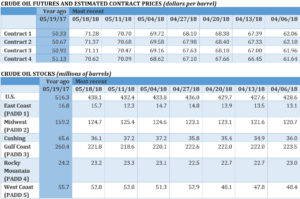

Below table shows decreasing Oil stocks, with consequently increasing crude oil futures contract prices.

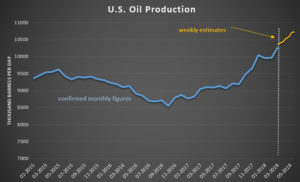

The increasing crude oil future contract prices and decreasing crude oil stocks is even more alarming, considering the fact that currently U.S. Oil Production is on a 3-year high, as can be seen from below chart.

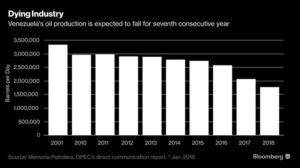

Venezuela’s Oil Meltdown:

Fresh off the reelection of Nicolás Maduro, U.S.A President Trump slapped new sanctions on Venezuela this week.

The sanctions prohibit U.S. companies from buying debt from the Venezuelan government – a directive that includes Venezuela’s largest oil company, PDVSA – to prevent President Maduro from attempting to sell off his country’s debt and pocketing the profits.

Venezuela’s oil infrastructure has been crumbling for years, and without money to hold it up, it will crumble to dust faster than anyone could imagine.

But the U.S. won’t be the last country to impose sanctions on the Venezuela government:

A coalition of 14 nations throughout the Americas have stated that they will not extend Venezuela any credit and would recall their ambassadors from Caracas.

Conclusion:

Based on the above, we believe that he age of chronically weak oil prices is over.

“Lower for longer” was a mantra taken on by Wall Street in the lower oil price environment. But with booming demand, a supply squeeze on the horizon, and geopolitical mayhem pushing crude oil faster than expected this year, the age-old adage is on its last legs.

In fact, there’s a huge – possibly massive – potential disruption on the horizon that could make the age-old adage flat line for good.

Due to the fact that Oil is the blood of the world, we can expect rising Oil prices to trigger a wave of global inflation, that might like the one of one we have experienced at the end of the seventies.

Based on this we consider the sell-off of the oil prices last Friday at the eve of the 2018 driving and cooling season as a great buying opportunity.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration and keep in mind that; commodity prices don’t move in a straight line and that Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek