Dear PGM Capital Blog reader,

In this weekend blog article, we want to elaborate on the investment strategy of world’s biggest Sovereign Wealth Fund, “The Norwegian Government Pension Fund Global”.

WHAT IS A SOVEREIGN WEALTH FUND:

A sovereign wealth fund (SWF) is a state-owned investment fund or entity which comprises of pools of money derived from a country’s reserves. Reserves are funds set aside for investment to benefit the country’s economy and its citizens.

THE NORWEGIAN GOVERNMENT PENSION FUND GLOBAL:

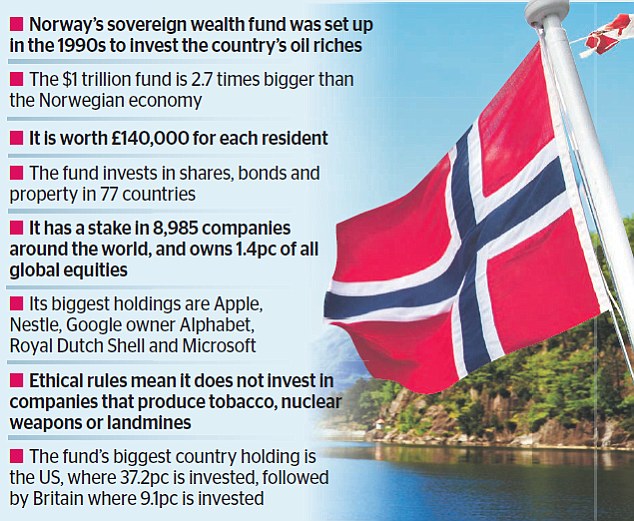

The Government Pension Fund Global, also known as the Oil Fund, was established in 1990 to invest the surplus revenues of the Norwegian petroleum sector. It has over US$1 trillion in assets, including 1.3% of global stocks and shares, making it the world’s largest sovereign wealth fund. In May 2018 it was worth about US$195,000 per Norwegian citizen.

It holds portfolios of real estate and fixed-income investments. Many companies are excluded by the fund on ethical grounds.

Norges Bank Investment Management manages the fund on behalf of the Ministry of Finance, which owns the fund on behalf of the Norwegian people.

The ministry determines the fund’s investment strategy, following advice from among others Norges Bank Investment Management and discussions in Parliament. The management mandate defines the investment universe and the fund’s strategic reference index.

INVESTMENT STRATEGY:

The fund was set up to give the government room for manoeuvre in fiscal policy should oil prices drop or the mainland economy contract. It also served as a tool to manage the financial challenges of an aging population and an expected drop in petroleum revenue.

Bought 22 billion USD of stocks during 2018 yearend rout:

The world’s biggest sovereign wealth fund went on a stock buying spree during the market turmoil at the end of 2018.

Norges Bank, which manages Norway’s $1 trillion oil-funded wealth pot, said on Wednesday February 27, that it bought 185 billion crowns (US$21.7 billion) worth of equities, with the bulk of purchases coming in November and December.

Despite the Norges Bank purchases, the fund’s overall market value dipped over the course of 2018 by 6.1 percent, marking a steep reverse from the 13.7 percent growth witnessed in 2017.

During 2018, equity investments for the fund returned a loss of 9.5 percent, while unlisted real estate investments gained 7.5 percent, and fixed-income investments returned 0.6 percent.

At the end of 2018, the fund’s biggest equity holdings were in Microsoft (US$7.5 billion), Apple (US$7.3 billion), Alphabet (US$6.7 billion), Amazon (US$6.4 billion), Nestle (US$6.3 billion) and Royal Dutch Shell (U$6 billion).

After a strong start to 2019 for stocks, the Norges Bank website said the fund is currently valued at US$1.03 trillion.

Divesting from Oil and Gas Exploration:

On Friday, March 8, it was announced that the fund will sell off stakes in oil and gas exploration and production companies investments, but will still hold stakes in firms such as BP and Shell that have renewable energy divisions.

The strategy shift, on the back of advice from the country’s central Norges Bank, will affect 1.2% of its equity holdings, worth about 66billion Norwegian krone (7.5 Billion USD).

The recommendation by Norway’s central bank pushed down shares in European oil companies. Europe’s index of oil and gas shares hit its lowest level since mid-October on the news and was trading down 0.39% by late afternoon.

In a statement the bank explained that:

“The return on oil and gas stocks has been significantly lower than in the broad equity market in periods of falling oil prices,”

“Therefore, it is the bank’s assessment that the government’s wealth can be made less vulnerable to a permanent drop in oil prices if the GPFG [sovereign wealth fund] is not invested in oil and gas stocks”

PGM CAPITAL’s ANALYSIS AND COMMENTS:

We follow very closely the investment strategy of the Norwegian Government Pension Fund Global, and use it a a guideline for the advise regarding asset allocation and securities to include in our client’s portfolio.

The fact that the fund used the rout of the Q4-2018 to increase its equity holdings sustain below quote from Warren Buffett.

The fact that the fund has experienced a lost of 6.1 percent in 2018, based on the market rout of Q4-2018, proves that a well diversified portfolio isn’t immune to systematic risk and that the fund correctly has used this rout to grap un high quality securities at a discount.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. A Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek