Dear PGM Capital blog readers,

In this weekend blog article, we want to elaborate on the possibilities that Cash and fixed Income securities, might become more riskier than Stocks in the near future.

INTRODUCTION:

Cash & Savings Account:

Cash and Savings accounts are places that you can park your cash and gain interest on it. Effective short term savings accounts are ones that permit you to meet your needs in the short term, for which, the access to the funds is critical.

Cash and Savings accounts should allow you to withdraw funds from the account whenever you need. This should be accomplished through convenient methods like ATM cards or online means. In most countries funds in all types of cash & savings accounts are insured up to a certain amount per account.

Fixed Income:

Fixed income is a type of investment security that pays investors fixed interest payments until its maturity.

Treasury bonds and bills, municipal bonds, corporate bonds, and certificates of deposit (CDs) are all examples of fixed-income products.

Fixed income investments in the form of Treasury bonds (T-bonds) have the backing of the U.S.A. government. Fixed income CDs in most countries are insured by the Central Bank up to a certain amount per individual.

Stocks:

A stock (also known as “shares” or “equity”) is a type of security that signifies proportionate ownership in the issuing corporation. This entitles the stockholder to that proportion of the corporation’s assets and earnings.

Owning stock gives the owner (share holder) the right to vote in shareholder meetings, receive dividends (which are the company’s profits) if and when they are distributed, and it gives him/her the right to sell his/her shares to somebody else.

Stocks are not insured and shareholders, are last in line and often receive nothing, or mere pennies on the dollar, in the event of bankruptcy. This implies that stocks are inherently riskier investments than cash and fixed income.

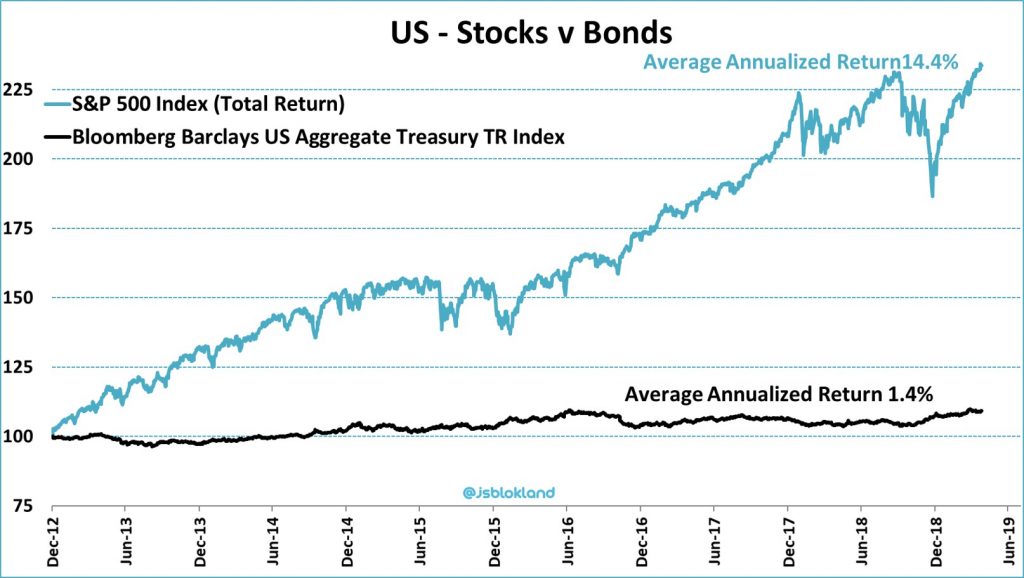

However historically, stocks have outperformed cash and fixed income over the long run as can be seen from below chart.

FRACTIONAL RESERVE BANKING;

Fractional reserve banking is a system in which only a fraction of bank deposits are backed by actual cash on hand and available for withdrawal. This is done to theoretically expand the economy by freeing capital for lending.

In most countries, the reserve requirements set by their respective Central Bank is 10%, which means that banks in this case are required to keep 10% of the deposit, referred to as reserves.

This increases the risk for holder of Cash and Capital deposits (CD) in case there is a run on the bank.

PGM CAPITAL’s ANALYSIS & COMMENTS:

According to the above provided information, besides the risk of having deposits larger than the insured amount by the respective Central Banks, cash and Fixed Income, look relatively safer than stock investing.

However since the beginning of this millennium the following flaws have crept into the market, which might jeopardize the safeness of cash and Fixed Income.

Fast Increasing Global Debt Level:

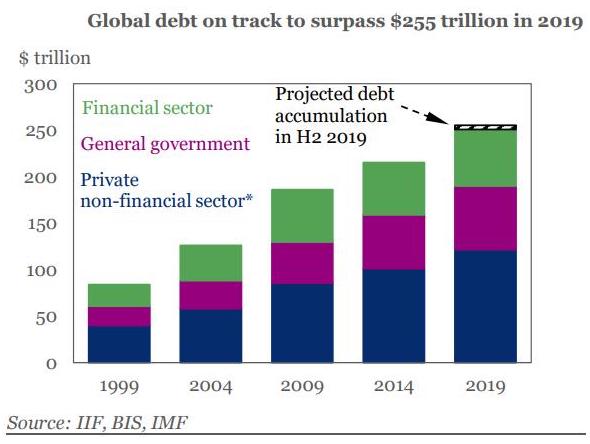

As can be seen from below chart, global debt is on course to end 2019 at a record high of more than US$255 trillion, the Institute of International Finance estimated, which is nearly US$ 32,500 for each of the 7.7 billion people on planet.

Fixed Income investors are the holders of this debt, which means if the issuers of these debts are unable to repay them, Fixed Income investors might find themselves in the dark.

Steadily Decreasing Interest Rates:

Most of European countries already have zero to negative interest rates.

As can be seen from below chart, interest rates in the USA, have been declining steadily since 1990 and might reach Zero around 2024.

Negative interest rates mean that depositors, must pay an interest to the bank for it to hold their deposit. Zero interest will lead to negative real rate of return of cash depositors and Income investors.

Real rate of return=Nominal interest rate−Inflation rate

Low or zero interest rates negatively affect people who live of the interest income from their savings.

As a consequence of near zero to negative interest rates, banks might lose deposit. On top of this when interest rates become zero or negative it will hurt bank’s business model lending money of approx. two point five times (2.5) the credit interest rate provided to depositors. They can’t any more earn a profit. Thus zero or negative interest rates could mean a shake out in the banking sector if they don’t find alternative ways to serve their customers and maintain their profitability.

The above mentioned flaws combined with fractional reserve banking, makes cash deposits and fixed Income investments, less attractive compared with blue chips stocks which on average appreciate yearly with 8% – 10% on top of a dividend yield approx. 3%.

Conclusion:

If the above mentioned trends continue, we might experience an increase of volatility in the markets, with a lot of shake-out and consolidation in the financial sector.

A word of Caution:

During this volatile period, some companies and financial sector, might try to attract you with interest rates that are much higher than the ones of prime or investment grade institutions. Our advise is to be very careful, and always keep in mind the following.

In this era of uncertainties, PGM Capital is at your service as your, Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek