Dear PGM Capital Blog readers,

In this weekend’s blog article, we want to take the opportunity to discuss with you the appreciation of the Swiss Franc against the Euro and the US-Dollar, despite billions spent by the Swiss National Bank (SNB) to curb the franc’s advance.

INTRODUCTION:

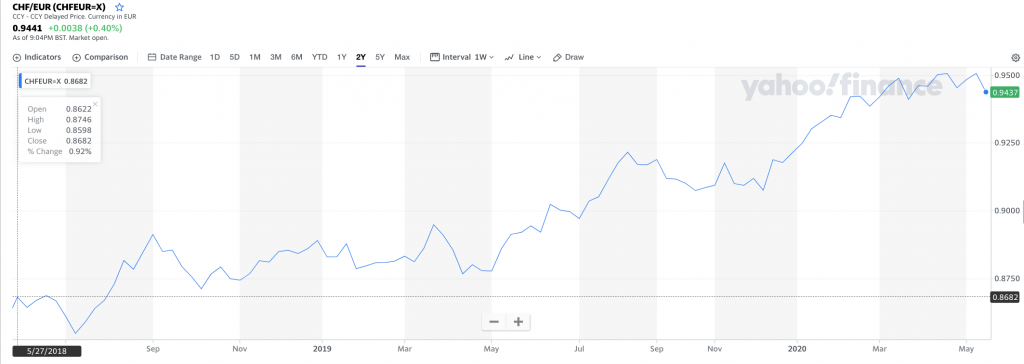

With the global economy in recession and the Euro Area risking a new debt crisis, the Swiss Franc – a popular monetary haven – has reached a 2-year high against the Euro of CHF 0.9510, as can be seen from below chart.

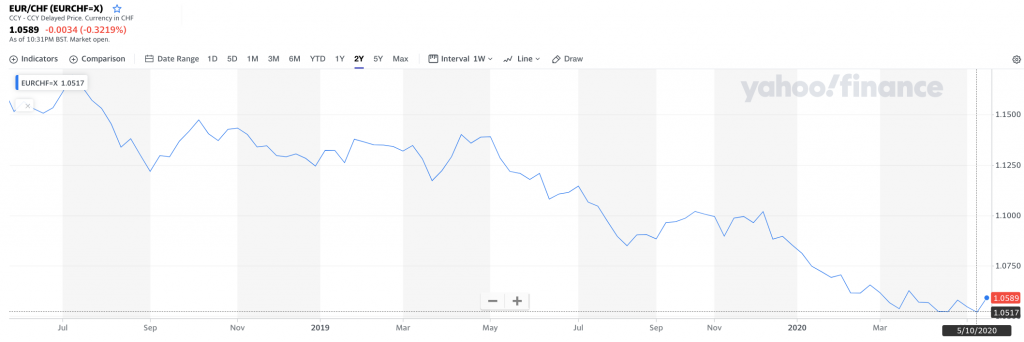

Below chart of the exchange rate Euro to CHF, shows that on May 10, the Euro has reached its lowest value in 2 years against the Swiss Franc of Euro 1.0517.

Even the German-French agreement for a European Union aid package failed to derail options bets that signal the pair may soon be on equal footing for the first time since 2015.

Fears of how badly the coronavirus will hurt economies worldwide are just the latest in a long list of reasons why demand for the franc is high. The franc is a haven because neutral Switzerland, with its banks, rule of law, and political stability, has for decades been considered the one of the safest places for the world’s rich to park their money.

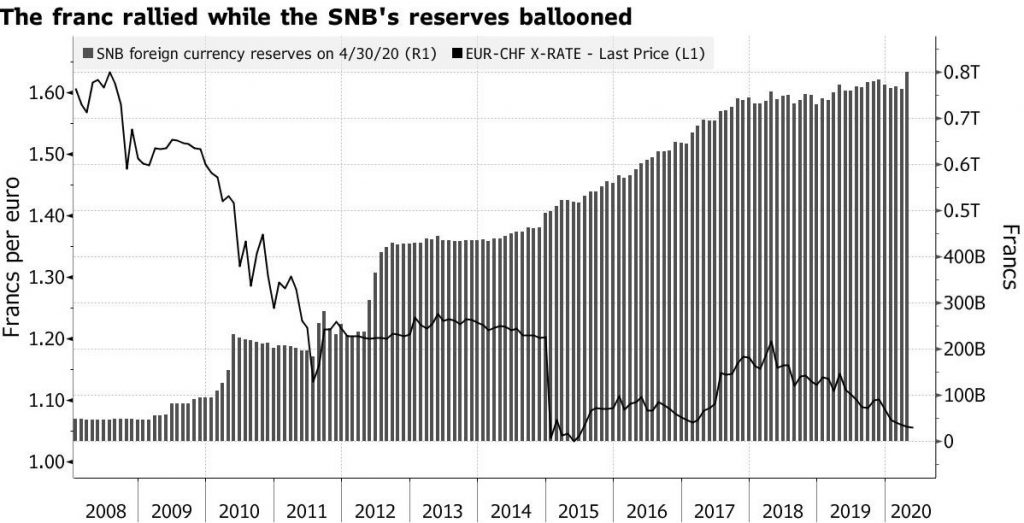

The Swiss National Bank (SNB) has struggled to tame the currency for years, with the institution injecting CHF454billion into the foreign-exchange market since 2009 as can be seen from below chart.

Despite billions spent by the Swiss National Bank to curb the franc’s advance, the currency rose about 30% in a decade as can be seen from above chart.

PGM CAPITAL’s ANALYSIS & COMMENTS:

If this trend continues, the Swiss franc may hit parity with the euro for the first time since 2015, when the Swiss National Bank shocked markets by lifting its currency cap, in January 2015.

A Rising CHF and the Swiss Economy:

The SNB’s balance sheet has ballooned over the past decade as the bank has snapped up other currencies in an attempt to hold down the franc.

The SNB believes an overvalued currency, driven up by panicked investors seeking a haven for their cash, would create deflation and spell disaster for Swiss exporters.

Simply handing the franc over to the vicissitudes of the market would send it soaring, making Swiss goods abroad more expensive, and potentially causing manufacturers to lose orders and banks to see profitability evaporate.

Another consideration is what a stronger franc means for inflation. While cheaper imports are a boon for shoppers, they’re a headache for policymakers whose mandate is to keep the rate of inflation positive but under 2%. Consumer prices have dropped for the past three months on a year-on-year basis.

The Lowest Interest rate in the world:

With the franc near a two-year high against the euro, the SNB’s decade-old battle against an overly strong currency is back in focus.

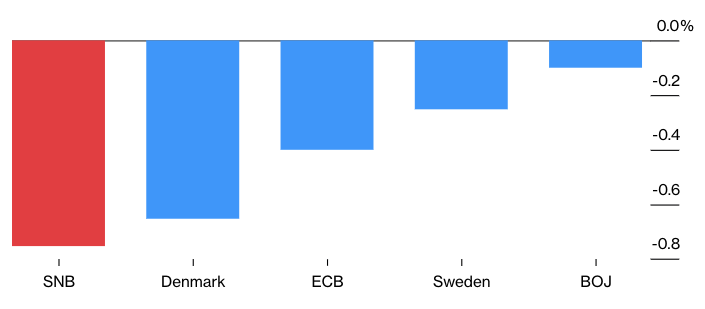

Because the Swiss franc is regularly used as a safe haven currency in times of crisis, the SNB was forced to go below zero, in 2015. Five years ago, for which its current interest rate is -0.75%.

As can be seen from below chart, the SNB is one of five central banks with negative rates in the world.

The effect of rising CHF exchange rate for Investors in Swiss Securities:

As can be seen from figure 1, the exchange rate of the CHF has appreciated with approx. 8% against the Euro, which means that Euro-zone investors investing in Swiss securities have enjoyed an eight percent appreciation above of the appreciation of their CHF notated securities.

Disclosure:

We own shares of several Swiss multinationals in our personal portfolio.

PGM Capital is at your service as your, Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek