Dear PGM Capital Blog readers,

On Thursday, January 7, shares of Rio Tinto as well as the ones of BHP Group hit an all time high. In this weekend blog article we are going take in-depth look regarding this event.

INTRODUCTION:

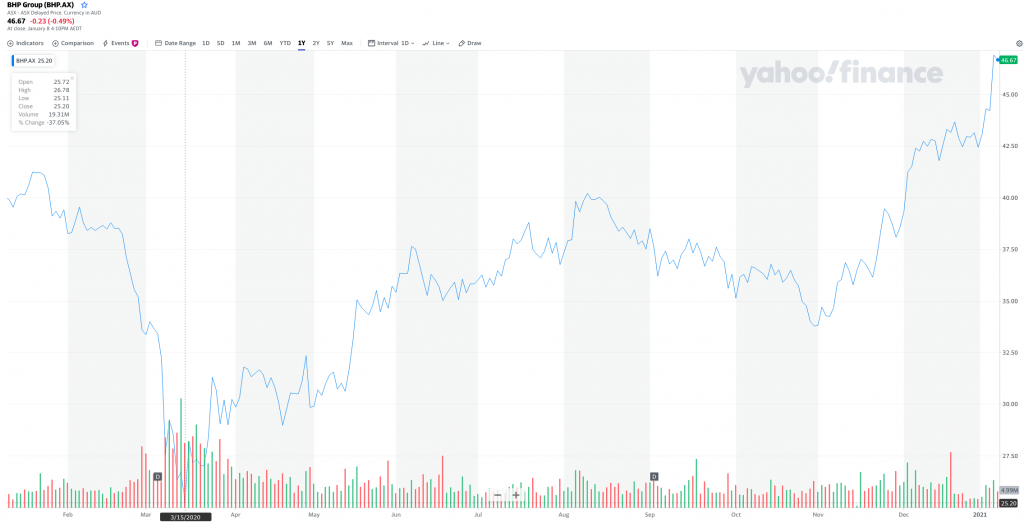

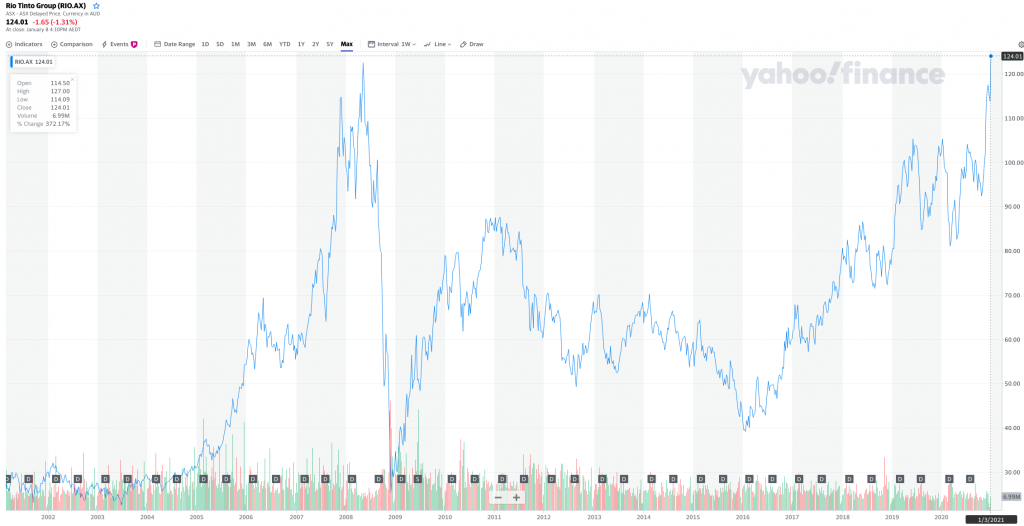

Two of the largest metals and mining companies in the world – BHP Group (BHP.AX) and Rio Tinto (RIO.AX) – have had stellar run-ups in share prices since early spring of 2020 as can be seen from the below charts.

BHP GROUP

Headquartered in Melbourne, Australia, BHP has diversified operations in four segments: coal, copper, iron ore and petroleum.

It purchases and operates large long-life commodity-producing resource assets, such as coal mines or iron quarries. Its portfolio of assets, which is considered among the highest quality in the world, has been generating significant free cash flow.

Rio Tinto

Rio Tinto, a British-Australian multinational metals and mining corporation, also owns several world-class assets across several different commodities.

It has generated strong free cash flow over the last few years and returned the majority of it to shareholders through dividends and buybacks.

WHY DID THE RIO TINTO and BHP SHARE PRICE ROCKET HIGHER?

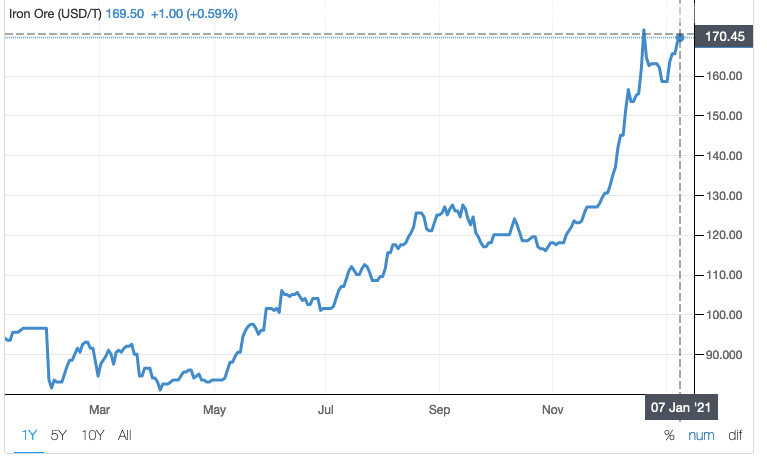

Investors were fighting to buy the shares of both companies on Thursday, January 7, after the iron ore price continued its ascent as can be seen from the below chart.

The steel making ingredient and other commodities climbed higher after the Democrats won the Georgia Senate run-off. This effectively hands control of the Senate to the Democrats, paving the way for further stimulus to boost economic growth in the United States.

This in turn should underpin demand for many commodities and support the high prices that many are commanding.

PGM CAPITAL COMMENTS & ANALYSIS:

Value investing is easily one of the most popular ways to find great stocks in any market environment. After all, who wouldn’t want to find stocks that are either flying under the radar and are compelling buys, or offer up tantalizing discounts when compared to fair value?

One way to find these companies is by looking at several key metrics and financial ratios, many of which are crucial in the value stock selection process.

A key metric that value investors always look at is the Price to Earnings Ratio, or PE for short.

This shows us how much investors are willing to pay for each dollar of earnings in a given stock, and is easily one of the most popular financial ratios in the world.

The best use of the PE ratio is to compare the stock’s current PE ratio with: a) where this ratio has been in the past; b) how it compares to the average for the industry/sector; and c) how it compares to the market as a whole.

Rio Tinto:

| Forward P/E | 11.19 |

BHP:

| Forward P/E | 12.79 |

Dr. Copper:

The term Doctor Copper is market lingo for this base metal that is reputed to have a “PhD. in economics” because of its ability to predict turning points in the global economy.

Because of copper’s widespread applications in most sectors of the economy – from homes and factories to electronics and power generation and transmission – demand for copper is often viewed as a reliable leading indicator of economic health.

This demand is reflected in the market price of copper.

As can be seen from the below chart, the price of copper is currently at a 52-weeks high.

Main Street versus Wall Street:

“Main Street vs Wall Street” is used to describe the contrast of general consumers, investors, or small local businesses with large investment corporations.

Main Street represents the small and local ones, including small businesses, general individual investors, and small independent investment firms. Wall Street, as a symbol of high finance, refers to large investment firms, high net-worth investors, and global businesses.

While main street in 2020 was in the grip of COVID-19, lockdowns etc., Wall Street rocketed to all time, for which the price of Iron ore and the one of copper have surged to 5-year high.

The rising price of copper indicates that Wall Street might be right and Main Street, is wrong in the sense that inflation, -hyperinflation- is on the horizon.

The fact that shares of BHP and the ones of Rio Tinto are trading at an all time high -as can be seen the from below chart -, might be a confirmation of the above.

Based on the above, we maintain our BUY rating on the share of both Rio Tinto as well as BHP Group.

Disclosure:

We own shares of BHP Group as well as the ones of Rio Tinto in our personal portfolio.

In the rapidly changing world and subsequent turbulence, PGM Capital is at your service as your Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek