Dear PGM Capital blog readers,

Foremost, we hope that you are safe and are following the instructions your government has implemented in order to flatten the curve of the spread of the Coronavirus in your country.

During the last three weeks, we have worked at least sixteen hours a day, seven days a week in order to provide our clients updates, outlook and advise regarding the impact of the coronavirus and Oil war on the markets.

In this belated weekend’s blog article, we want to discuss with you the possible effect of the Coronavirus outbreak may have on your investments and why it is important to flatten the curve of its spread A.S.A.P.

WHY IS FLATTENING THE CURVE CRUCIAL:

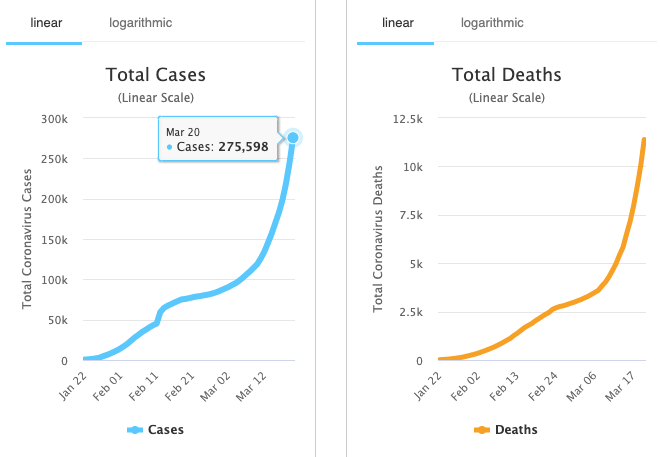

New viruses, like the coronavirus, for which our body doesn’t have the required antibody can generate an exponential growth of infected people, as we can see from below chart.

Efforts to completely contain the new coronavirus — the pandemic responsible for infecting hundreds of thousands of people in 130 countries with the disease, called COVID-19 — have failed.

In one month, the global number of confirmed COVID-19 cases has more than 75,000 cases from February 20 to 275,598 on March 20.

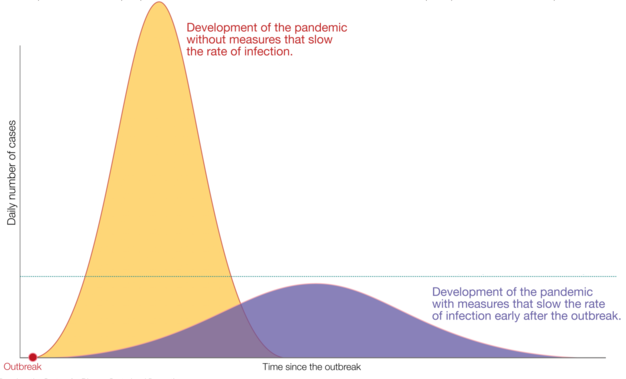

This is why we need to flatten the curve of its spread.

Flattening the curve refers to community isolation measures that keep the daily number of disease cases at a manageable level for medical providers.

THE WORST WEEK FOR THE MARKETS SINCE 2008:

Wall Street’s worst week since 2008:

The Dow Jones Industrial Average finished trading on Friday down 913 points, a drop of 4.55%, as U.S. markets concluded the worst week since 2008. Despite rallying earlier in the day, all three major indexes closed negative, with the S&P 500 and Nasdaq Composite down 4.3% and 3.8%, respectively.

For the week of March 16, the Dow Jones Industrial Composite, the S&P 500 and Nasdaq Composite, declined with respectively 5.1%, 3.4% and 0.4% as can be seen from below chart.

Crude suffers its worst week since 1991:

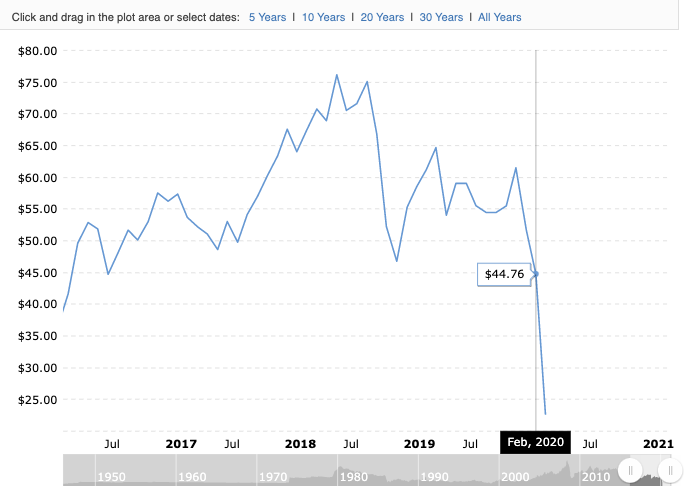

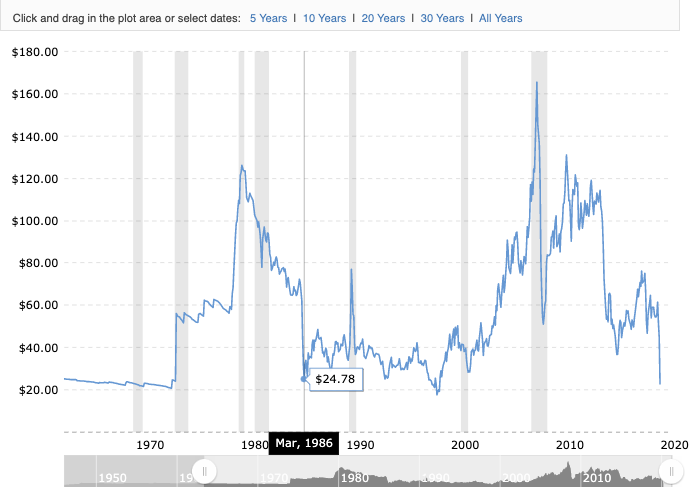

The U.S. West Texas Intermediate crude dropped 8.76% Friday, March 20 to close at $23.64 per barrel, posting its worst week since January 1991. It was also oil’s fourth straight down week. So far this month, WTI is down nearly 44%, as can be seen from below chart.

The decline of the oil price in March of this year put it on pace for its worst month ever since the inception of the contract in 1983.

PGM CAPITAL COMMENTS & ANALYSIS:

Stimuli and rate cuts Globally:

The USA has cut interest rates to almost zero and launched a US$ 700 billion stimulus program in a bid to protect the economy from the effect of coronavirus.

It is part of a co-ordinated action announced taken by the UK, Japan, Eurozone, Canada, Australia, New Zealand and Switzerland.

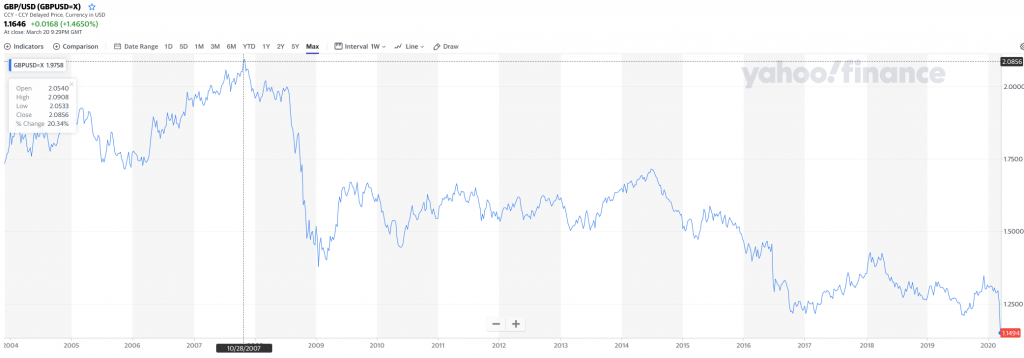

These QE and rate cuts are diluting the purchasing value of money bringing the exchange rate of for example the GBP and AUD to an all time low against the USD as can be seen from below chart.

Long term bonds prices were also hammered, bringing the value of most of them far below parity.

On the other hand, these Stimuli and rate cuts will inflate asset prices, for which we believe that shares of food producing companies will profit the most.

The Oil price war:

On March 8. 2020, Saudi Arabia kicked off an oil price war with Russia -triggering a major fall in the price of oil, with US oil prices falling by 34% – at a time when the world is dealing with the coronavirus outbreak .

This oil war and subsequent oil price collapse looks almost similar with one of 1986 as can be seen from below chart.

Similar with 1986, we expect this oil war to bring serious loss in revenue for oil-producing countries, and oil companies. At the end, it might lead to massive devaluation of the currencies of some of those countries and bankruptcy for some of these small oil companies.

On the other hand, these lower oil prices which has lead to a decrease of the value of the shares of the Oil supermajors have made their dividend yield above 10 percent, which can be considered as an excellent entry point for long term investors.

Disclosure:

For our own portfolio, we own shares of food-producing companies as a hedge against the dilution of money and have bought in shares of the Royal Dutch Shell and BP, for their high dividend yield.

In this rapidly changing world and subsequent turbulence, PGM Capital is at your service as your Professional, Trustworthy and Dedicated, Financial Advisor and Asset Management.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that the market can remain irrational longer, than you can remain solvent.

Yours sincerely,

Eric Panneflek