Dear PGM Capital blog readers,

In this weekend’s blog article, we want to take the opportunity to discuss with you why Investing in Aurora Cannabis at current price, can be lucrative for growth investors.

INTRODUCTION:

Aurora Cannabis Inc. is a Canadian licensed cannabis producer, headquartered in Edmonton, Alberta Canada.

As of late September 2018, Aurora Cannabis had eight licensed production facilities, five sales licences, and operations in 24 countries. It had a funded capacity of over 500,000 kilograms of cannabis production per annum.

Shares of the company trades on the Toronto Stock Exchange as ACB. and it also has a secondary listing on the New York Stock Exchange.

Aurora is the second largest cannabis company in the world by market capitalization, after Canopy Growth Corporation (TSE: WEED).

FUNDAMENTAL ANALYSIS:

In this article, we are going to estimate the intrinsic value of Aurora Cannabis Inc., by estimating the company’s future cash flow and discounting them to their present value.

This is done using the Discounted Cash Flow (DCF) model.

The calculation:

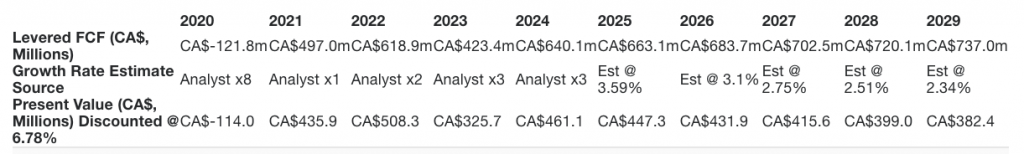

We use what is known as a 2-stage model, which simply means we have two different periods of growth rates for the company’s cash flows. Generally the first stage is higher growth, and the second stage is a lower growth phase.

First, we have to get estimates of the next ten years of cash flows. Where possible we use analyst estimates, but when these aren’t available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

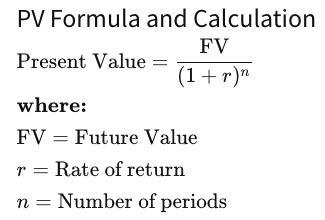

Generally we assume that a dollar today is more valuable than a dollar in the future:

10-year free cash flow (FCF) forecast:

Present Value of 10-year Cash Flow (PVCF)= CA$3.7 Billion.

Terminal Value Calculation:

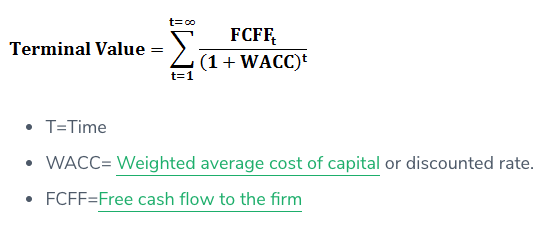

In finance, the terminal value (continuing value or horizon value) of a security is the present value at a future point in time of all future cash flows when we expect stable growth rate forever.

For several of reasons, a very conservative growth rate is used that cannot exceed that of a country’s GDP growth. In this case, we have used the 10-year government bond rate (1.9%) to estimate future growth. In the same way as with the 10-year ‘growth’ period, we discount future cash flows to today’s value, using a cost of equity of 6.8%.

Terminal Value (TV) = FCF2029 × (1 + g) ÷ (r – g) = CA$737m × (1 + 1.9%) ÷ (6.8% – 1.9%) = CA$16 billion

Present Value of Terminal Value (PVTV) = TV / (1 + r)10 = CA$CA$16b ÷ ( 1 + 6.8%)10 = CA$8.06 billion

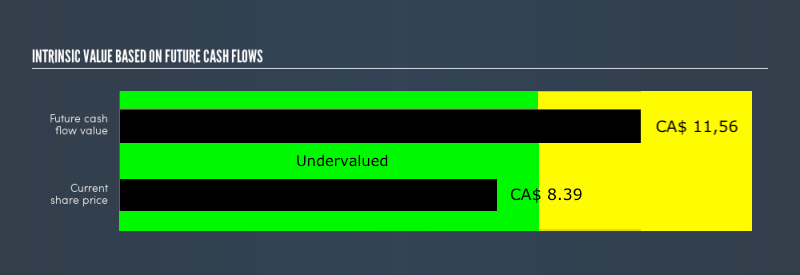

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is CA$11.76 billion.

To get the intrinsic value per share, we divide this by the total number of shares outstanding. This results in an intrinsic value estimate of CA$11.56

Relative to the current share price of the shares on Friday August 3rd 2019, of CA$8.39 the company appears about fair value at a 28% discount to where the stock price trades currently.

PGM CAPITAL’s ANALYSIS & COMMENTS:

Based on the above, the company appears undervalued at a 27% discount to where the stock price trades currently.

Based on the above calculation, we maintain our BUY rating on the shares of the company at current price level

Disclosure 1:

We own shares of Aurora Cannabis Inc., in our personal portfolio.

Disclosure 2:

Due to the very complex calculations outlined in this article we have start writing it early July and finished it on Friday, August 2.

Word of Caution:

Although the valuation of a company is important, it should not be the only metric you look at when researching a company. The DCF model is not a perfect stock valuation tool. Rather it should be seen as a guide to “what assumptions need to be true for this stock to be under/overvalued?”

Increasing Cannabis Short Interest:

Short selling activity in the cannabis sector has risen throughout this year, bringing the total amount bet against a portfolio of 150 U.S. and Canadian cannabis stocks and ETFs to US$5.1 billion by the end of July, according to S3 Partners.

Over 84% of this short interest is concentrated in just 20 stocks, and these stocks have seen short interest increase by $1.89 billion or 78.32% so far in 2019.

Last but not least, before taking any investment decision, always take your investment horizon and risk tolerance into consideration. Keep in mind that share prices do not move in a straight line. Past Performance Is Not Indicative Of Future Results.

Yours sincerely,

Eric Panneflek